Advertisement|Remove ads.

Temu Parent PDD Holdings’ Stock Tumbles As CEO Sees Revenue Growth Challenges, Retail Sentiment Crashes

Shares of PDD Holdings (PDD), the parent company of Pinduoduo and the recently launched U.S. platform Temu, took a nosedive on Monday after its Q2 report revealed slower-than-expected revenue growth and CEO’s warning of upcoming challenges.

The news sent shivers down investors' spines, with the stock price crashing 24%.

Second-quarter revenue did climb 86% year-over-year to a hefty 97.06 billion yuan ($13.64 billion), but fell short of Wall Street’s estimate of about 100 billion yuan.

Adjusted earnings per American depository share (ADS) of $3.20, however, beat the analyst consensus estimate of $2.73.

"While encouraged by the solid progress we made in the past few quarters, we see many challenges ahead,” said Chairman and Co-Chief Executive Officer Chen Lei, adding that the company was ready “to accept short-term sacrifices and potential decline in profitability.”

PDD's leadership suggested they were taking a long-term view, prioritizing investments in platform security, merchant support.

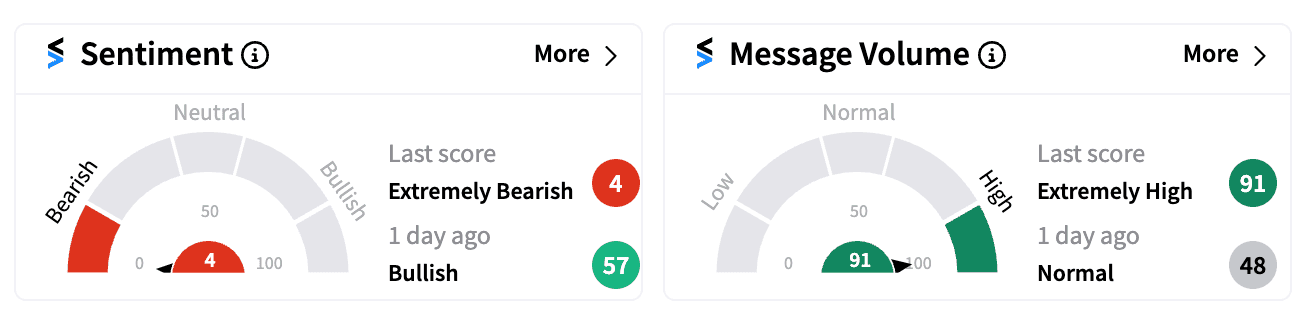

As Wall Street panicked, retail investors on Stocktwits felt the anxiety as sentiment turned ‘extremely bearish’ (4/100) at the open, falling to its lowest level this year.

“$DQ $JD $PDD All China stocks are getting hammered,” wrote one bearish user on the platform.

“The allure of ‘deep value’ suckers many. It’s just that they underestimate and misprice risk,” wrote another retail follower.

However, some retail followers pointed out the strong earnings per share and year-over-year revenue growth, arguing that analyst estimates might have been too lofty.

The report also acknowledged a challenging environment in China, with a fragile economy and a cautious consumer base.

The earnings report also affected PDD's main competitor, JD.com (JD), whose U.S.-listed stock dipped over 3%. Even Alibaba (BABA), China’s e-commerce giant, felt the heat as shares fell more than 4% on Monday.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ui_Path_jpg_ca2cd2d4b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_youtube_logo_resized_jpg_3b8ecc8150.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Astra_Zeneca_jpg_a49cc22562.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_jpg_6c4cc95d17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_amazon_2_resized_jpg_5ac5c32fa5.webp)