Advertisement|Remove ads.

Peabody Energy Rises After Hinting About Scrapping $3.8B Coal Mines Deal, Retail’s Still Bearish

Peabody Energy (BTU) stock rose 5.6% on Monday after the company indicated that it might choose to terminate its $3.8 billion deal to buy Anglo American’s steelmaking coal assets.

The company said that it has notified Anglo American of a material adverse change impacting the deal, related to the Moranbah North Mine, which remains inactive following what was described as a gas ignition event on March 31.

"While we have remained on track to complete the steelmaking coal acquisition from Anglo, the issues at Moranbah North have created significant uncertainty around the transaction," CEO Jim Grech said.

The deal was expected to close in mid-2025.

"A substantial share of the acquisition value was associated with Moranbah North, yet there is no known timetable for resuming longwall production," Grech added.

Anglo American said that it does not believe that the stoppage at Moranbah North constitutes a material adverse change, and it would continue to work with Peabody to address its concerns.

While Donald Trump’s favorable policies towards coal have renewed enthusiasm around the sector, tariffs on steel imports and an ongoing trade war between the U.S and China have dampened the demand outlook.

As reported by The Fly, BMO analysts stated that Peabody's actions are unsurprising given that the Moranbah mine event coincides with the currently soft operating environment and a more challenging debt market.

The brokerage noted that this event does not constitute a material adverse change on its own, and Peabody’s claim would likely be challenged.

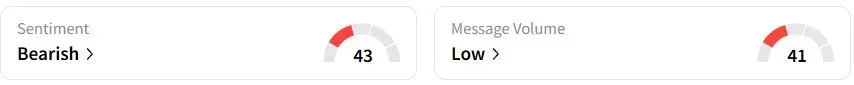

Retail sentiment on Stocktwits was in the ‘bearish’ (43/100) territory, while retail chatter was ‘low.’

One retail trader was pleased that the management was not buying a “non-working” asset.

Peabody Energy stock have fallen 36% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_vertex_logo_resized_4070318817.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_shell_resized_jpg_161ef0a394.webp)