Advertisement|Remove ads.

Peloton Rises Pre-Market After UBS Upgrade: Retail Wonders If It's The Next 'Meme Stock' Play After 19% Surge

Retail buzz around Peloton (PTON) surged Wednesday after the workout bike maker's shares jumped on the back of an analyst upgrade, fueling speculation that it could become the next meme-stock sensation.

Shares rose nearly 19% in the session, and 0.2% in premarket trading on Thursday. UBS upgraded its rating on the stock to 'Buy' from 'Neutral,' and price target to $11 from $7.5. The latest view signals a 78% rise from the stock's close on Tuesday.

The shares are trading at a favorable risk/reward and "undemanding" valuation, according to a summary on the investor note on The Fly.

"While that inflection in connected fitness subs is not entirely clear to us yet, we are seeing better data trends for Peloton in terms of traffic and active users," the research firm said.

It added that the firm will likely raise its expectations for Peloton's FY2026 EBITDA, driven by further top-line growth and cost-cutting measures.

Peloton, known for its connected fitness equipment and subscription-based platform, has seen its business decline since 2021, after a surge in demand during the COVID-19 lockdowns when consumers turned to at-home workouts.

Peloton's sales have shrunk in each of the last three years, and its stock is down about 96% from its high in January 2021.

The company has implemented several initiatives to revive the business, including last year's 15% job cuts, a strategic pivot toward subscription sales over hardware, and the introduction of AI-powered personalized coaching. Peloton brought in Peter Stern, a co-founder of Apple Fitness+, as CEO late last year to lead the turnaround efforts.

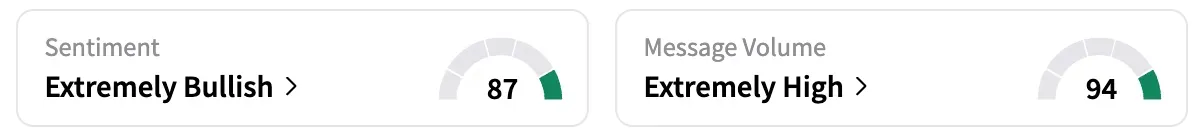

On Stocktwits, retail sentiment shifted to 'extremely bullish' (90/100) as of early Thursday, from 'bullish' the previous day. Message volume surged about 2,000% in the past 24-hour period.

"$PTON next meme name??" a user remarked, a nod to the recent meme buzz-fueled rally in names like Opendoor Technologies (OPEN) and Krispy Kreme (DNUT), among others.

Another bullish user said the company has been "cleaning up the loose spending for years," and could post a "surprise triple beat on August 7."

Currently, nine out of 21 analysts covering the stock have a 'buy' or higher rating, while 11 rate it 'hold' and one rates it 'sell,' according to Koyfin data. Their average price target is $9.06.

Despite Wednesday's gains, PTON shares are still down 15.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Tesla Pokes Fun At Viral Sydney Sweeney American Eagle Ad: 'Our Seats Robot Also Has Great Jeans'

/filters:format(webp)https://news.stocktwits-cdn.com/large_blue_owl_capital_jpg_4d9954c2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553061_jpg_699278f844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trump_media_and_technology_group_media_009b60f8cd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HP_corporate_logo_resized_a2479d3136.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_terawulf_OG_jpg_a87a18705d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)