Advertisement|Remove ads.

After Opendoor And Kohl’s Rally, Krispy Kreme Rides Meme Stock Sugar High

The “meme stock” mania is back. After pumping Opendoor Technologies (OPEN) and Kohl's Corp (KSS) stocks in recent days, retail investors and social media crusaders now have a new favorite: Krispy Kreme (DNUT).

Shares of the donut chain jumped nearly 27% to $4.13 on Tuesday — marking their best intraday performance in over a year — fueled by a social media frenzy with no clear fundamental trigger. As of the day before, DNUT stock was down about 66% year-to-date.

Over the past 24 hours, user discussions on Reddit, X, and Stocktwits have surged, with many indicating a potential short squeeze and predictions on where the stock might head next.

The popular Reddit forum r/wallstreetbets, which was highly influential in the “meme stock” frenzy of 2021, saw increased chatter, with one thread post stating: "DO or $DNUT There is no Try."

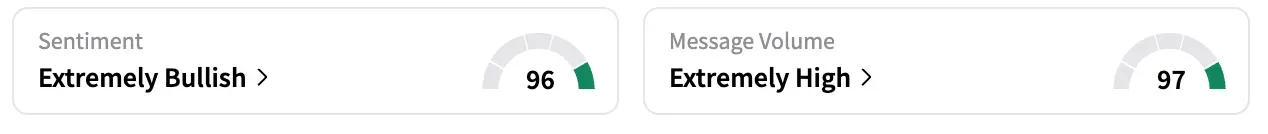

On Stocktwits, the retail sentiment for DNUT shares shifted from 'bearish' (24 hours ago) to 'extremely bullish' (96/100), accompanied by a surge in message volume of over 3,500%.

"$DNUT is about to go nuts soon and tomorrow a bigger sweet squeeeze," said a user, while user forecasts for DNUT stock price on Wednesday ranging from $9 to $12.

Several users on X said they had bought Krispy Kreme shares, with one noting that the DNUT ticker is "simple, catchy, and instantly memeable," and the buzz appeared to be fueled by posts from multiple high-profile X accounts in recent hours.

The stock rally comes even as Krispy Kreme's core business struggles. Weighed down by inflation and economic uncertainty, consumers have been pulling back on dining out, particularly on indulgences such as coffee and donuts. The company has posted declining sales for three consecutive quarters.

Krispy Kreme also recently ended a key partnership with McDonald's, which analysts have said is concerning for the donut company.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Alibaba’s Qwen-3 Coder Takes Aim At OpenAI’s GPT-4, Anthropic’s Claude In Code Generation Battle

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)