Advertisement|Remove ads.

Peloton Stock Rallies On Turnaround Signs, Retail Investors Turn ‘Extremely Bullish’

Peloton Interactive Inc (PTON) shares soared as much as 28% on Thursday, marking their biggest one-day jump in over a year after the company's quarterly earnings report, which hinted at a potential comeback.

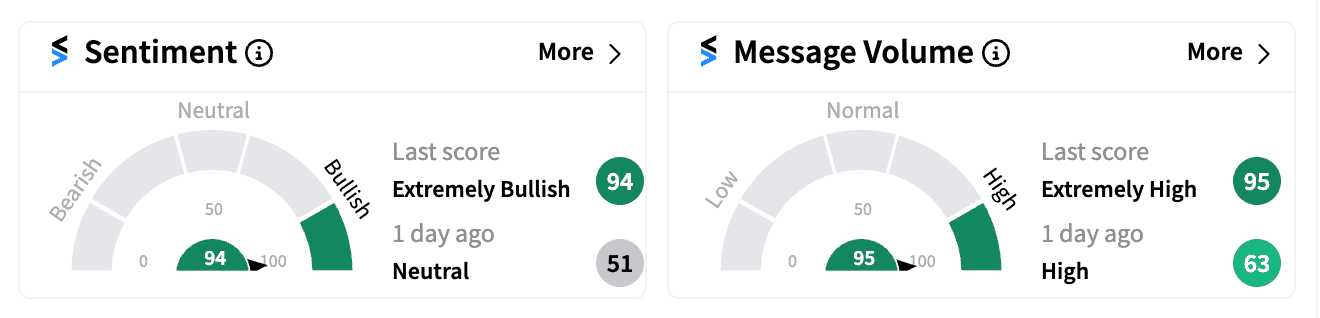

Retail investors turned ecstatic, driving the sentiment score on Stocktwits to ‘extremely bullish’ (94/100) – the highest level this year.

This earnings report, the first since former CEO Barry McCarthy stepped down earlier this year, offered some positive signs for Peloton's turnaround strategy led by two board members.

Sales finally increased for the first time in nine quarters, indicating an end to the downward trend. June-quarter losses significantly shrunk by 87% to $30.5 million, showcasing progress towards profitability.

The key subscription segment saw a 2.3% revenue rise and a 1% point improvement in gross margin. Peloton generated positive free cash flow of $26 million, compared to negative figures in previous quarters.

Still, Peloton acknowledged ongoing challenges: sales of signature bikes and treadmills continuing to dip; expectations of hardware and app subscribers declining based on economic uncertainties; and the ongoing hunt for a permanent CEO.

Despite these hurdles, retail investors on Stocktwits expressed strong confidence in Peloton's future.

They praised the company's cost-cutting measures and focus on cash flow generation.

Some even compared Peloton's potential turnaround to the recent success story of Carvana, the used-car retailer that reported its first-ever annual profit earlier this year and has since been on a mission to strengthen its balance sheet.

In the coming months, investors are likely to keep an eye on Peloton's ability to retain and grow its subscriber base, the impact of the broader economic climate on consumer spending and the appointment of a new CEO in the coming months.

But for now, they have regained full confidence in the stock that last saw its heyday during the COVID-19 pandemic in 2021.

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)