Advertisement|Remove ads.

PepsiCo's Quarterly Sales Expected To Slide Again: Market Eyes Tariff Commentary Amid Bullish Retail Mood

Snacks and sodas giant PepsiCo (PEP) will report first-quarter earnings before the bell on Thursday, with analysts closely watching its forecast, including any potential change to its full-year view, and commentary on tariff impact.

The earnings report will likely set the tone for the packaged consumer foods sector this earnings season and give a peek into how they will reposition themselves against higher import duties.

President Donald Trump imposed steep reciprocal tariffs on all U.S. trading partners this month, only to pause them later—driving up anxiety for businesses, which now expect costs to rise amid uneven demand.

According to Koyfin data, PepsiCo is expected to report a 2.9% drop in Q1 revenue — its third straight quarter of sales decline.

Wall Street expects adjusted earnings to fall to $1.49 per share from $1.61 last year.

Investors are looking for signs of business revival as the company's U.S. market share has dropped in the last few years due to competition with sodas from Keurig Dr Pepper (KDP) and weakness in its own Frito-Lay snacks division.

The company saw downgrades from Bank of America and Barclays recently.

Meanwhile, the U.S. food regulator said this week that it will phase out artificial colorants in food items by next year, which will affect food and drink makers, including PepsiCo.

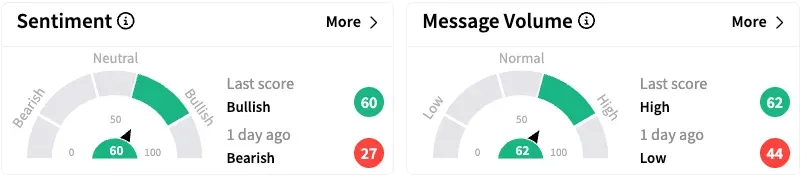

On Stocktwits, the sentiment flipped to 'bullish' from 'bearish' a day earlier, signaling optimism heading into the earnings.

One user said they would buy the stock if it dips on earnings. "It's funny how stocks get sold off over short-term headwinds," they said.

PepsiCo stock is down 6.4% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)