Advertisement|Remove ads.

Permian Resources Stock Rises After $608M Purchase Of APA Assets, Retail Remains Bearish

Permian Resources (PR) stock gained 1% in after-hours trading on Wednesday after the company agreed to buy some Delaware Basin assets from APA Corp for $608 million.

The company said it would gain access to 13,320 net acres and 8,700 net royalty acres adjacent to its assets in New Mexico.

The company expects to produce 12,000 barrels of oil equivalent per day (boepd) from the acquired assets in the second half of the year.

“We believe the addition of high-quality assets adjacent to our core position, acquired during a lower commodity price environment, will further enhance short and long-term returns for investors,” co-CEO James Walter said.

Permian Resources reported first-quarter adjusted earnings of $0.42 per share, which missed Wall Street’s estimates of $0.43 per share, according to FinChat data.

Its average sales price for oil fell to $70.48 per barrel from $76.13 per barrel a year earlier.

The company’s total production rose to 373,209 boepd compared with 319,514 boepd a year earlier.

The company reduced its cash capital expenditure by 3% at the mid-point to $1.9 billion to $2.0 billion from $1.9 billion to $2.1 billion, projected earlier. It did not alter its production forecast.

U.S. shale oil producers are focusing on minimizing costs as oil remains depressed due to fears of a recession and oversupply from OPEC+.

“Underpinned by high-return inventory and improved business fundamentals, we expect to deliver similar free cash flow at $60 per barrel WTI for the remainder of 2025 as we did in 2024 at $75 per barrel,” Walter said.

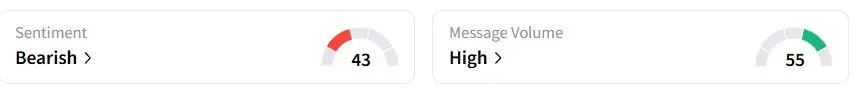

Retail sentiment on Stocktwits was in the ‘bearish’ (43/100) territory, while retail chatter was ‘high.’

However, one user said that “undervalued is a strong understatement” for the stock, and it could hit $20 soon.

Permian Resources stock has fallen 18.6% year to date (YTD).

Also See: Mining Giant Barrick’s CEO Says Mali Junta Doesn’t Want ‘Badly Run Legal Fight,’ Retail’s Bearish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)