Advertisement|Remove ads.

Perpetua Resources Speaking With Glencore, Trafigura To Bolster US Antimony Refining Amid China Export Ban: Report

Perpetua Resources (PPTA) is reportedly in talks with Glencore, Trafigura, and other parties about a partnership to refine antimony in the U.S., amid widespread efforts to diversify the supply chains of the critical mineral.

According to a Reuters News report, the company confirmed that it is speaking with two companies, alongside Clarios and Sunshine Silver, about a refining partnership and intends to request proposals in the coming weeks, with a decision expected by the end of the year.

Antimony has a wide range of applications, including night vision technology, explosives, armor-piercing ammunition, and grid-scale energy storage batteries. Perpetua’s Stibnite project holds the biggest reserve of antimony in the U.S. The company began construction at the mine last week, having secured all the necessary permits.

"We are encouraged by emerging opportunities to expand domestic mineral processing capacity in America and intend to make well-informed, market-based decisions when selecting a partner," Jon Cherry, Perpetua's CEO, reportedly stated.

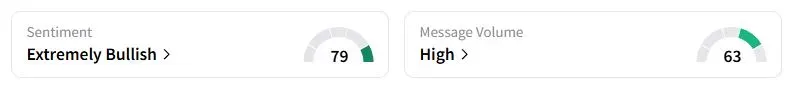

Retail sentiment on Stocktwits about Perpetua was in the ‘extremely bullish’ territory at the time of writing.

The Trump administration is seeking to bolster the domestic mining industry in an effort to reduce its reliance on China, which accounted for over 80% of U.S. antimony exports. Earlier this week, another refiner, United States Antimony, got a contract worth up to $245 million from the U.S. Defense Logistics Agency to supply antimony metal ingots.

Once operational, the Pentagon-backed Stibnite project could supply 35% of the anticipated U.S. antimony demand, according to the United States Geological Survey 2025. The project also holds 4.8 million ounces of gold, which will be another source of earnings for the company.

Perpetua stock has nearly gained 76% this year, compared with a 60% rise of the SPDR Metals & Mining ETF (XME).

Also See: Why Did Lightpath Technologies' Stock Fall After-Hours Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)