Advertisement|Remove ads.

Why Did Lightpath Technologies' Stock Fall After-Hours Today?

Lightpath Technologies’ (LPTH) stock fell nearly 3% in extended trading on Thursday after the optics and imaging systems provider posted a wider loss in the fiscal fourth quarter.

The Orlando, Florida-based company reported a net loss of $7.1 million, or $0.16 per share, for the quarter ended June 30, compared to a loss of $2.4 million, or $0.06 per share, in the same quarter of the prior fiscal year.

The loss widened primarily due to its acquisition of New Hampshire-based G5 Infrared, which it bought for $27 million in February. The G5 business specializes in long-range mission-critical detection solutions, focusing on defense, border security, and counter-drone markets.

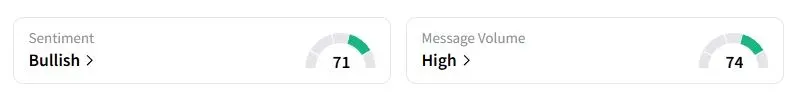

However, the company’s revenue increased to $12.2 million, compared to $8.6 million in the fourth quarter of the previous year. Its revenue was also in line with analyst estimates, according to Fiscal.ai data. Retail sentiment on Stocktwits about Lightpath still moved into ‘bullish’ territory, compared with ‘neutral’ a day ago.

Lightpath has invested heavily in developing proprietary technologies, including black diamond glass, which is free of germanium, a mineral primarily supplied from China. Beijing slapped export restrictions on the mineral in December last year amid ongoing trade tensions with the U.S.

“Our backlog today is around $90 million. That is more than 4x what the backlog was just a few months ago. And with more than 2/3 of this backlog in systems and subsystems,” CEO Sam Rubin said.

“Not happy with the margins this [quarter] they just reported, but that's headed higher going forward as they explained and will be profitable starting [in the] second half of next year,” one user said.

The stock has risen over 80% this year. Earlier this month, Lightpath received $8 million in strategic investment from emerging defense industry players Ondas and Unusual Machines.

Also See: Trump Shocks Pharma With 100% Tariff On Imported Drugs Unless Companies Build In America

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)