Advertisement|Remove ads.

‘Powell Is Helping Housing’ Says Peter Schiff As Economist Defends Fed Chair Against Trump’s Attacks

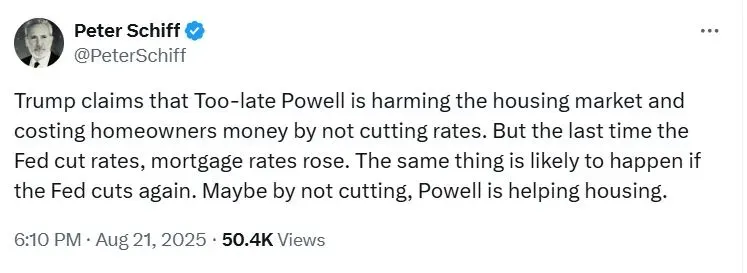

Economist Peter Schiff on Thursday defended Federal Reserve Chair Jerome Powell over his stance on interest rates, days after Trump blamed the U.S. central bank for elevated mortgage rates.

“The last time the Fed cut rates, mortgage rates rose. The same thing is likely to happen if the Fed cuts again,” Schiff wrote on X. “Maybe by not cutting, Powell is helping housing.”

Earlier this week, President Donald Trump launched a fresh attack on Powell, blaming the banker for hurting the housing industry “very badly.” He also called for a major rate cut next month.

Powell is scheduled to speak on Friday at Jackson Hole, Wyoming, in the U.S. central bank’s annual symposium, where investors will be glued to his every word, which could give a hint toward the Fed’s interest rate pathway.

While inflation has come down from pandemic-era levels, it remains above the central bank’s 2% mandate. The U.S. consumer price index (CPI) rose 2.7% annually in July, with core CPI rising 0.3% sequentially, the highest increase since January.

Minutes from July’s Federal Open Market Committee (FOMC) meeting showed that while Federal Reserve officials remain worried about Trump’s tariffs driving up inflation, they stated that their outlook for the labor market has weakened.

Retail sentiment on Stocktwits about SPDR S&P 500 ETF Trust (SPY) was in the ‘bullish’ territory at the time of writing, while traders were ‘bearish’ about the Invesco QQQ Trust Series 1, which tracks the NASDAQ 100.

According to Freddie Mac data, the 30-year mortgage rate stood at 6.58% on average last week, while the 15-year mortgage rate was 5.69%. According to the mortgage firm, rates have decreased over the summer, and purchase applications are now outpacing 2024. However, many homebuyers continue to wait on the sidelines for further rate declines.

Luxury homebuilder Toll Brothers had revised its housing deliveries outlook lower and flagged affordability concerns. Fiber cement maker James Hardie also painted a dour outlook for housing demand in key growth areas such as Texas and Florida.

The Federal Reserve cut interest rates by half a percentage point last September, and then delivered two quarter-point reductions in the following months. However, mortgage prices had risen to over 7% in the subsequent months. The central bank has maintained present rates at 4.25%-4.50% levels this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lithium_47e0215e10.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_evolent_jpg_3c3f2aa8e5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250655281_jpg_c8c0e9352f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)