Advertisement|Remove ads.

Peter Schiff Slams DJT Of ‘Little Intrinsic Value’ After Trump Media’s Fusion Pivot — Says Political Leverage Is the Real Deal

- Schiff questioned the company’s shifting strategy, pointing to repeated pivots across unrelated businesses.

- He argued the merger highlights access and influence rather than operating fundamentals.

- The comments came as Trump Media continues to face weak revenue trends and ongoing losses.

Trump Media & Technology Group (DJT) drew sharp criticism from economist Peter Schiff after announcing a $6 billion merger with fusion energy company TAE Technologies.

The stock rose nearly 35% to $13.98 at the time of writing, and are on-track to log their best day in nearly 2 years.

Schiff Questions Trump Media’s Intrinsic Value

In a post on X, Schiff said DJT “has little intrinsic value beyond its connection to the President,” arguing that the company’s business model has shifted repeatedly without a clear operating focus.

He said Trump Media “began as a social media company, pivoted into a Bitcoin treasury company, and is now merging with a fusion energy company,” adding that the “constant reinvention makes clear that the business itself is not the point.”

‘Political Leverage’ At The Center Of The Merger

Schiff said the merger underscores what he views as Trump Media’s primary appeal to partners. “The only real value DJT offers an energy company is political leverage: access to power and the prospect of favorable treatment from the Trump administration,” he wrote.

“With this merger,” Schiff added, the company is now “obviously well positioned to monetize that access.”

Political Comparisons

Schiff also drew comparisons to past controversies involving Former President Joe Biden’s family. “The Bidens must be green with envy,” he wrote, adding that Republicans who previously criticized the Bidens would be “total hypocrites” if they remained silent now, arguing that “the Bidens were dealing in chump change compared to the billions flowing to the Trumps.”

Trump Media’s Struggles

Trump Media has lagged over the past year despite President Donald Trump’s frequent use of Truth Social to announce policy positions and tariff updates. The company’s financial results have not matched the platform’s political visibility, with losses rising over the first three quarters of 2025 and revenue growth remaining modest.

The company went public in March 2024 through a SPAC merger. Truth Social accounts for the bulk of its revenue, with smaller contributions from Truth+, its video streaming service, and fintech unit Truth.Fi. Trump Media also holds about $2 billion worth of Bitcoin.

From Social Media To Crypto To Fusion Energy

The merger with TAE Technologies marks a major strategic shift for Trump Media. TAE, founded in 1998, focuses on developing nuclear fusion power plants using beam-driven Field-Reversed Configuration technology and also operates businesses in power management and life sciences.

In a joint statement, the companies said the all-stock deal would combine Trump Media’s “access to significant capital” with TAE’s fusion technology, with the goal of building what they described as the world’s first utility-scale fusion power plant.

Devin Nunes, chair and chief executive of Trump Media, said the transaction would allow the company to “[take] a big step forward toward a revolutionary technology that will cement America’s global energy dominance for generations.”

How Did Stocktwits Users React?

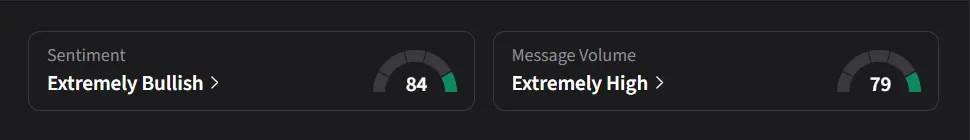

On Stocktwits, retail sentiment for DJT was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “Another day of Donald J Trump providing more value to the American people than all other presidents combined.”

One user said Trump’s momentum is spreading across multiple groups and suggested the stock could reach “triple digits.”

DJT’s stock has declined 58% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246906030_jpg_5d1c52da00.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246745935_jpg_973c37103a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tim_cook_OG_jpg_08b852f801.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)