Advertisement|Remove ads.

Philip Morris Shares Gain As Profit Outlook Improves, Earnings Top Estimates But Retail Isn’t Impressed

Philip Morris International Inc. ($PM) stock rose as much as 4% in pre-market trading on Tuesday after the company reported third-quarter earnings that surpassed estimates and also raised its full-year guidance.

Revenue for the quarter grew 8.4% year-over-year (YoY) to $9.91 billion, exceeding Wall Street's expectations of $9.68 billion. Earnings per share (EPS) hit $1.97, beating the estimated $1.82.

Philip Morris also raised its full-year profit guidance, now projecting adjusted diluted EPS growth of up to 15%, an increase from the previous estimate of 13%.

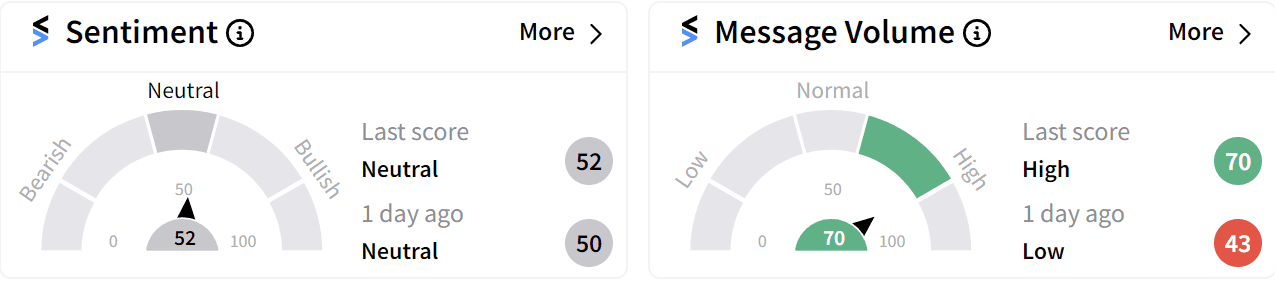

Retail sentiment on Stocktwits remained in the ‘neutral’ (52/100) territory ahead of the opening bell on Tuesday.

CEO Jacek Olczak attributed the robust results to the company's momentum across all regions and categories, particularly in its smoke-free and nicotine pouch product lines.

Like other tobacco giants in the industry, the company is trying to move toward cigarette alternatives amid rising public concerns and regulatory scrutiny.

Smoke-free products accounted for 38% of Philip Morris’ total net revenues and 40% of gross profit with its IQOS heated tobacco sticks driving growth, particularly in Japan and Europe.

In the US, the shipment of ZYN pouches, which contain nicotine and are taken orally by stuffing them under the upper lip, grew 41.1% YoY.

Phillip Morris shares are currently trading at over seven-year highs. The stock has gained 30% so far in 2024, and 36% in the last 12 months.

For updates and corrections email newsroom@stocktwits.com

Read More: General Motors Stock Climbs After Earnings Beat, Raised Guidance: Retail Sentiment Still Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)