Advertisement|Remove ads.

Phillips 66 Stock In Spotlight After Elliott Nominates 7 Directors, Retail Confidence Stays Low

Phillips 66 (PSX) stock was in focus on Tuesday after Elliott Investment Management nominated seven directors to the refiner’s board.

The activist investor’s nominees include John Pike, who is leading the campaign, as well as former executives at ConocoPhillips and Exxon Mobil.

“The director nominees announced today will bring the right experience and objective perspectives to the board as it executes the best path for the company,” Elliott said.

The refiner revealed in February that the size of its board would be reduced to 12 from 14 following this year's annual meeting as two directors chose not to stand for re-election.

Elliott unveiled a more than $2.5 billion stake in the company last month and urged it to sell or spin off its midstream business and a stake in the Chevron Phillips Chemical joint venture.

Phillips 66 operates about 72,000 miles of pipelines in the U.S. and ships refined products, crude oil, natural gas, and natural gas liquids nationwide.

Elliott, which is also running a campaign at British oil major BP, had said that Phillips 66 trades at a substantial discount to a sum-of-its-parts valuation and its management has failed to meet its targets.

Elliott first revealed a $1 billion stake in Phillips 66 in 2023 and said it was underperforming rivals Marathon Petroleum and Valero Energy.

Last year, Phillips 66 named former Shell executive Robert Pease to its board with Elliott’s blessings, and the investor gradually reduced its ownership interest before its latest campaign.

Elliott on Tuesday said it would identify the final slate of director candidates that will stand for election before filing its definitive proxy materials.

The hedge fund also urged the company to adopt a corporate governance policy, under which all directors would be up for re-election annually.

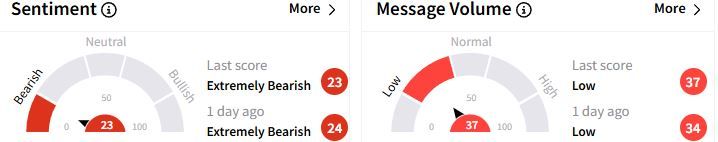

Retail sentiment on Stocktwits remained in the ‘extremely bearish’ (23/100) territory, while retail chatter was ‘low.’

Phillips 66 reported a sharp drop in quarterly profit in January and its refining segment posted a loss of $775 million, hurt by a slump in margins and depreciation costs related to the closure of its Los Angeles refinery.

Over the past year, Phillips 66 shares have fallen 14.7%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)