Advertisement|Remove ads.

AeroVironment Stock Tumbles After-Hours On Q3 Profit Miss, 2025 Forecast Cut: Retail’s Swayed By Long-Term Promise

AeroVironment (AVAV) shares fell more than 20% in aftermarket trading on Tuesday after the company posted third-quarter earnings below Wall Street’s estimates and cut its fiscal 2025 forecast.

The defense firm posted adjusted earnings of $0.30 per share for the three months ended Jan. 25, while analysts, on average, expected it to post $0.66 per share, according to FinChat data.

The company’s quarterly revenue fell 10% to $167.6 million compared to a year earlier. Wall Street expected it to post $206.4 million.

AeroVironment reported a net loss of $1.8 million, or $0.06 per share, for the third quarter, compared with a profit of $13.9 million, or $0.50 per share, in the year-ago quarter.

The Arlington, Virginia-based company said its product sales declined to $139.8 million during the quarter, from $155.9 million, for the same period last year, due to a 44% revenue fall in its UnCrewed Systems segments.

The decline was slightly offset by revenue increases in its Loitering Munitions Systems and MacCready Works segments.

The company also said that Southern California high winds, fires, and resulting blackouts and shutdowns hurt its revenue.

The company also slashed its fiscal 2025 revenue forecast to the range of $780 million and $795 million compared with $790 million and $820 million projected earlier.

The military drone maker cut its annual adjusted earnings forecast to $2.92 and $3.13 per share, compared with its earlier estimate of $3.18 to $3.49 per share.

“While this has been a transition year pivoting away from Ukraine demand, we still expect a strong fiscal year 2025, including record fourth quarter revenue,” CEO Wahid Nawabi said.

The company said that Ukraine would represent about 6% of its fourth-quarter revenue and is not material to its future growth plans.

Its funded backlog was a record $763.5 million at the end of Jan. 25, compared to $400.2 million as of April 30, 2024.

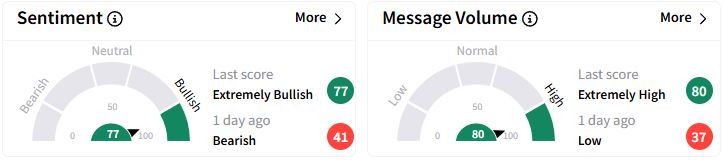

Retail sentiment on Stocktwits flipped to ‘extremely bullish’ (77/100) territory from ‘bearish’(41/100) a day ago, while retail chatter jumped to ‘extremely high.’

One user admitted that the company’s future looks ‘rough’ in the short term, but in the long term, the investment theme is backed by the closing of its $4.1 billion deal for BlueHalo and strong backlog.

Over the past year, AeroVironment stock has gained 5.1%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)