Advertisement|Remove ads.

Phoenix Mills: Buy The Dip Or Wait? SEBI RA Vijay Gupta Flags Critical Support Zones

SEBI-registered analyst Vijay Kumar Gupta has placed Phoenix Mills in the ‘wait and watch’ zone, noting that the stock is currently hovering near a key technical level.

After a drop from ₹1,575 to around ₹1,512, the stock is testing its near-term demand zone between ₹1,480 – ₹1,450, which had previously acted as a strong base in May - June. If this zone holds, a bounce-back towards the supply zone at ₹1,620 - ₹1,650 is possible, Gupta said.

A decisive move above ₹1,600 - ₹1,620, with strong volume, would shift momentum back in favor of an uptrend.

However, a breakdown below ₹1,450 could see the stock slide to the deeper support near ₹1,380 - ₹1,350, last seen during the 2024 lows.

At the time of writing, Phoenix Mills stock was down 1.45% to ₹1,501.

This technical uncertainty persists despite the company delivering robust fundamentals in its Q1 FY26 operational update.

Phoenix Mills reported a 12% increase in retail consumption, a threefold rise in residential bookings, and improved hotel occupancy across its major properties in the first quarter. It also reiterated its ambitious expansion strategies for retail, office, and residential assets.

Still, the near-term sentiment took a hit after Nomura initiated coverage with a “Reduce” rating and a ₹1,400 target, citing slowing consumption trends, margin pressures in Tier-2 properties, and premium valuations at ~24× FY26F EV/EBITDA.

On the other hand, ICICI Direct maintained Phoenix Mills as a top real estate pick due to its robust retail growth outlook.

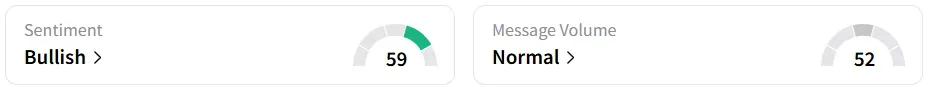

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier.

Year-to-date losses stood at 8.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)