Advertisement|Remove ads.

Pinterest Stock Eyes Worst Day In Over 3 Years As Q4 Outlook Disappoints — But Retail Traders Bet On Rebound

- Pinterest forecast fourth-quarter revenue below analysts’ expectations, following mixed Q3 results.

- The company’s management stated that ad spending was soft in the U.S. and Canada, particularly from retailers.

- Stocktwits sentiment for PINS shifted a level higher to ‘extremely bullish,’ with retail investors arguing for healthy growth across the company's metrics.

Pinterest, Inc.’s shares dropped 20% in the after-market session on Tuesday, even as Stocktwits sentiment ticked higher, after the online pin-board platform reported mixed quarterly results and issued a soft forecast for the current quarter.

Pinterest saw moderation in ad spending in the U.S. and Canada, particularly from retailers, CFO Julia Donnelly said on the analyst call. That comes on top of soft spending from Asian e-commerce companies, such as Temu and Shein, which have reined in ad budgets for the U.S. market after the removal of the "de minimis" exemption.

If the after-market moves carry over to Wednesday’s session, it would be the stock’s worst performance since May 2022.

What Is Retail Investors’ View?

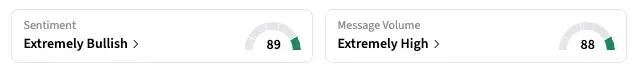

On Stocktwits, the retail sentiment for PINS shifted to ‘extremely bullish’ as of early Wednesday, up from ‘bullish’ the previous day.

“I can’t think of anything in the report I’m personally disappointed in,” said a user, citing revenue, EPS, and user growth, and buybacks. “For a stock that is trading at 15-16 forward p/e, how can this possibly be considered bad results? What more could you want?”

“Pinterest needs a correction to the upside,” said another user. Notably, as of the latest close, PINS shares are up just 13.5% year to date, trailing the benchmark S&P 500, which has risen more than 15%.

Q3 Performance & Outlook

Revenue rose 17%, to $1.05 billion, in line with analysts’ expectations. Monthly active users rose 12%, to 600 million, surpassing estimates by about 10 million.

Pinterest more than tripled its net profit $92.1 million, up from $30.6 million in the year-ago quarter. Barring the one-time items, earnings of $0.38 per share missed analysts’ expectations of $0.42 per share.

The damper was the financial outlook. The social media platform guided fourth-quarter revenue of $1.31 billion to $1.34 billion, representing 14% to 16% growth. That’s below the nearly 17% growth the past two quarters, and the $1.34 billion target from analysts polled by Reuters/LSEG.

Experts say the soft outlook is another indication that the majority of ad spending is gobbled up by larger digital platforms, by Meta and Alphabet.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: UPS Plane Crash: Kentucky Cargo Carrier Tragedy Claims At Least 7 Lives — Here's What We Know

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263890310_jpg_1f5b1fba80.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)