Advertisement|Remove ads.

Piramal Enterprises Nears Key Resistance: SEBI RA Says Rising Wedge Pattern Suggests Caution

Piramal Enterprises hit its highest levels in over three years this week. The stock climbed to ₹1,351 on July 15, a level last seen in February 2022.

At the time of writing, Piramal shares were up 0.4% at ₹1,325.50 on Thursday.

From a technical perspective, the stock has been trading within a rising wedge pattern on the monthly chart, as noted by SEBI-registered analysts Financial Independence.

The structure typically signals weakening momentum and the potential for a trend reversal if support levels are breached.

While the broader trend remains upward, the rising wedge formation warrants a cautious approach, they said. However, a decisive breakout above ₹1,350, supported by strong volume, could invalidate the bearish implications of the pattern and signal further upside.

The analysts maintain a cautious outlook on Piramal Enterprises in the short term. They recommend close monitoring of the price action near current levels and prioritizing risk management, especially if the price fails to break out convincingly above the ₹1,350 resistance zone.

In June, Piramal Enterprises infused ₹700 crore into its subsidiary, Piramal Finance (PFL), through a rights issue. The capital is expected to boost PFL’s general business operations and corporate requirements.

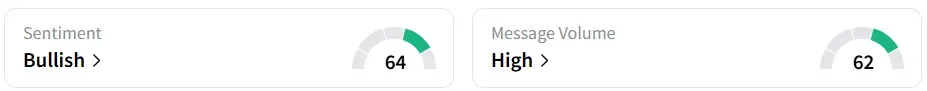

Retail sentiment remained ‘bullish’ on Stocktwits, amid ‘high’ message volumes.

Year-to-date, the stock has gained more than a fifth of its value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)