Advertisement|Remove ads.

Polestar Reports Narrower Q1 Losses, Significant Jump In Sales: Retail Turns Bullish

Swedish EV maker Polestar (PSNY) reported an 84% year-on-year surge in first-quarter revenue and a narrower net loss on Monday.

The company reported revenue of $608 million, up from $330 million in the corresponding period of 2024, but below an analyst estimate of $677 million, as per Koyfin data.

The revenue rise was primarily due to a 76.5% jump in retail sales, supported by newer models, to an estimated 12,304 cars.

The company’s net loss in the three months through the end of March fell to $190 million from $276 million in the corresponding period of 2024, driven by gross profit improvement, among other factors.

The company’s gross margin improved to 6.8% in the first quarter (Q1) from -7.7% in Q1 2024 due to a growing share of higher margin models.

Polestar said the joint venture with Hubei Xingji Meizu Group Co. in China has been terminated, and distribution rights have been transferred to the firm. However, the company asserted it remains fully committed to the Chinese market.

CEO Michael Lohscheller highlighted that Polestar has been taking steps to reduce its cost base.

“The geopolitical environment and market conditions are challenging, but we are on the right track and doing the right things,” he said.

Late last month, the Geely-backed company paused its financial guidance for 2025, citing current uncertainty surrounding international tariffs and government regulations impacting its business and market dynamics.

However, the company continues to target compound annual retail sales volume growth of 30-35% for 2025 to 2027, it had said.

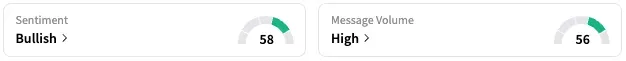

On Stocktwits, retail sentiment around Polestar jumped from ‘neutral’ to ‘bullish’ territory over the past 24 hours while message volume jumped from ‘normal’ to ‘high’ levels.

PSNY stock is down by about 3% this year and by over 20% over the past 12 months.

Also See: Rivian Stock Jumps Pre-Market After Bernstein, Stifel Raise Price Targets: Retail’s Pleased

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)