Advertisement|Remove ads.

Rivian Stock Jumps Pre-Market After Bernstein, Stifel Raise Price Targets: Retail’s Pleased

Shares of Rivian Automotive Inc. (RIVN) jumped over 4% in pre-market trading on Monday after multiple brokerages hiked their price targets on the stock.

Bernstein hiked its price target on Rivian to $7.05 from $6.10 while maintaining its ‘Underperform’ rating on the shares. However, the brokerage’s new price target still implies a 51% downside to the stock’s closing price of $14.26 on Friday.

The brokerage said that the company’s first-quarter earnings were better than feared, adding that the long-term path remains capital-intensive and scale-constrained. Rivian needs near-perfect execution through 2030 to reach scale, breakeven, and positive free cash flow – an ask too high in a sector known for surprises, the firm opined, as per TheFly.

Stifel analyst Stephen Gengaro also raised the firm’s price target on Rivian to $18 from $16 while keeping a ‘Buy’ rating on the shares. Stifel believes the company is making "solid progress toward several key milestones" despite near-term headwinds, and its long-term story is intact.

Rivian reported its first-quarter earnings last week, beating Wall Street expectations. However, the company trimmed its 2025 delivery outlook to 40,000 to 46,000 units from a prior projection of 46,000 to 51,000, citing tariff-related headwinds and macroeconomic uncertainty.

Rivian, however, still expects to achieve a modest positive gross profit for 2025.

According to data from Koyfin, 16 of 29 analysts covering the stock rate it a ‘Hold’, 10 rate it a ‘Buy’ or ‘Strong Buy', while three others rate it a ‘Strong Sell.’ The average price target on the stock is $14.06.

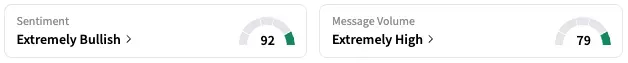

On Stocktwits, retail sentiment around Rivian remained unmoved in the ‘extremely bullish’ territory over the past 24 hours while message volume remained at ‘extremely high’ levels.

RIVN stock is up by about 8% this year and nearly 31% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)