Advertisement|Remove ads.

Fed Chair Jerome Powell Says Central Bank Can Wait For Greater Clarity Amidst Trump’s Significant Policy Changes

Federal Reserve Chairman Jerome Powell said the central bank does not need to be in a hurry amidst the Trump administration’s significant policy changes and that its current policy stance is well-positioned to deal with the risks and uncertainties in pursuing the dual mandate.

“Looking ahead, the new Administration is in the process of implementing significant policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation. It is the net effect of these policy changes that will matter for the economy and for the path of monetary policy,” Powell said in his speech at the University of Chicago Booth School of Business 2025 U.S. Monetary Policy Forum.

The Fed chair noted that although there have been recent developments in some areas, especially trade policy, uncertainty around the changes and their likely effects remains high.

“As we parse the incoming information, we are focused on separating the signal from the noise as the outlook evolves. We do not need to be in a hurry and are well-positioned to wait for greater clarity,” he said.

Powell’s speech coincided with the release of the February payroll data. The U.S. Bureau of Labor Statistics reported that total non-farm payroll employment rose by 151,000 in February, and the unemployment rate changed little at 4.1%.

According to a CNBC report, this is better than the downwardly revised 125,000 in January but less than the 170,000 consensus forecast by Dow Jones.

Powell acknowledged that wages are growing faster than inflation and more sustainably than earlier in the pandemic recovery. “With wage growth moderating and labor supply and demand having moved into better balance, the labor market is not a significant source of inflationary pressure,’ he said.

The Fed Chair’s speech was the last important signal to the market before the Federal Open Market Committee meets on March 18-19, with the central bank’s blackout period commencing on Saturday.

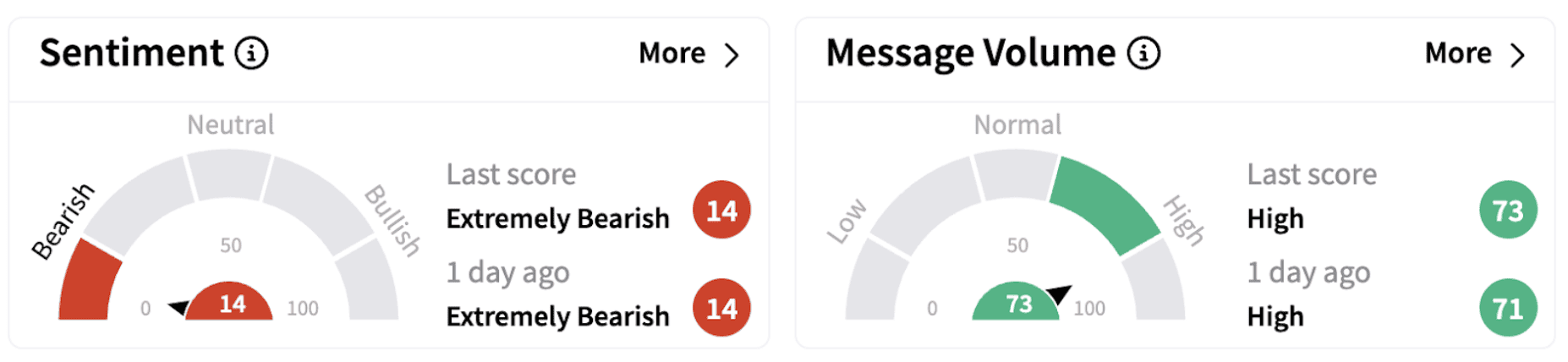

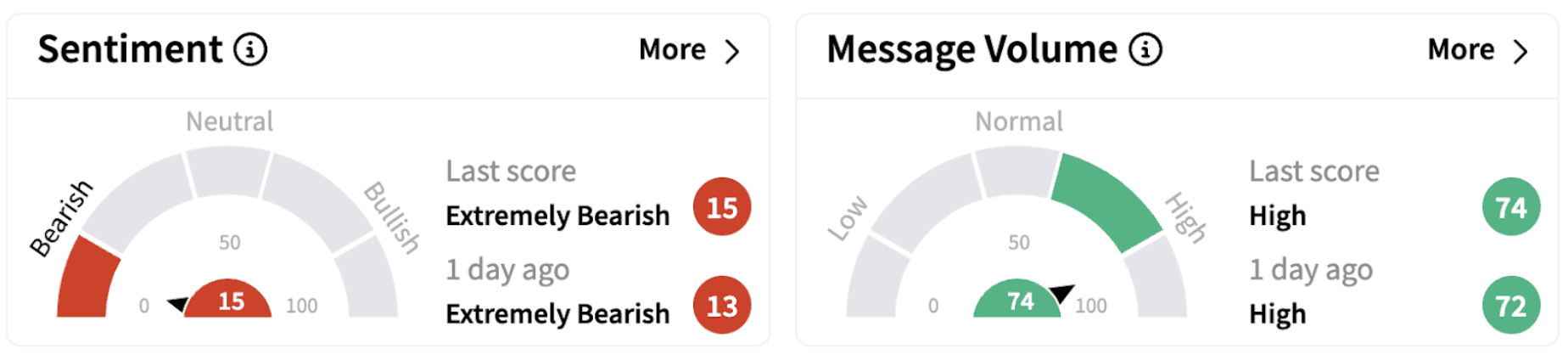

Following Powell’s remarks, benchmark U.S. indices traded in the green. However, retail sentiment surrounding the SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust, Series 1 (QQQ) trended in the ‘extremely bearish’ territories.

According to the CME FedWatch Tool, traders are factoring in a 97% probability that the Fed will keep rates unchanged in the March policy. The consensus indicates the earliest rate cut is likely to happen in June.

The SPY has lost nearly 2% in 2025, while the QQQ is down over 4%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bigtechs_jpg_63ac524cdb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231155247_jpg_4c42250aff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bill_Holdings_jpg_f481f21546.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)