Advertisement|Remove ads.

Morgan Stanley Expects January Core CPI To Accelerate 0.37% Over Wildfires, Seasonality Issues

Morgan Stanley expects January 2025 core consumer price index (CPI) print at 0.37%, significantly above the December 2024 figure. Headline CPI inflation is expected to come in at 0.35% month-on-month. The data is expected to be released on Wednesday.

The company attributed the acceleration to the effect of wildfires and seasonality issues that tend to add an upward bias to inflation. However, the annual core CPI figure is expected to come in line with the December reading of 3.2%.

“We still expect high used and new car inflation because of wildfires, and acceleration in certain goods that seem to show strength in January (drugs, motor vehicle parts, recreation commodities),” Morgan Stanley said in a note.

The firm expects rent inflation to increase just one basis point in January with a 0.32% month-over-month print. Hotels, medical services, and car insurance are expected to accelerate, boosting core services ex-housing, it said.

Morgan Stanley explained that its predictors of car insurance inflation continue to suggest gradual deceleration ahead, strong demand and higher oil prices keep airfares inflation in positive territory.

Late last month, the Bureau of Economic Analysis released the December personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred gauge of inflation, which continued to trend above the central bank’s targeted levels.

PCE rose 2.6% on a year-over-year (YoY) basis in December. The reading stands 0.2 percentage points higher than the November figure but aligns with expectations.

Core PCE index, which excludes food and energy and is considered as a better gauge of long-term inflation, increased 2.8% from a year ago, again in line with expectations.

According to the CME FedWatch Tool, traders anticipate the next rate cut of 25 basis points in July 2025.

Recently, Morgan Stanley dialed down its rate cut expectations to only one reduction worth 25 basis points in 2025 compared to its previous view of two rate reductions through the year due to the ongoing tariff wars by the Trump administration.

The firm said that imposing tariffs more quickly than assumed would likely mean disinflation halts at a higher pace of inflation, blocking any near-term path to cuts.

“Even if tariffs are avoided, we think their potential keeps uncertainty about PCE inflation elevated and keeps risks to PCE inflation tilted to the upside. We now only look for one rate cut this year in June. The path for monetary policy in 2025 remains highly uncertain,” the note stated.

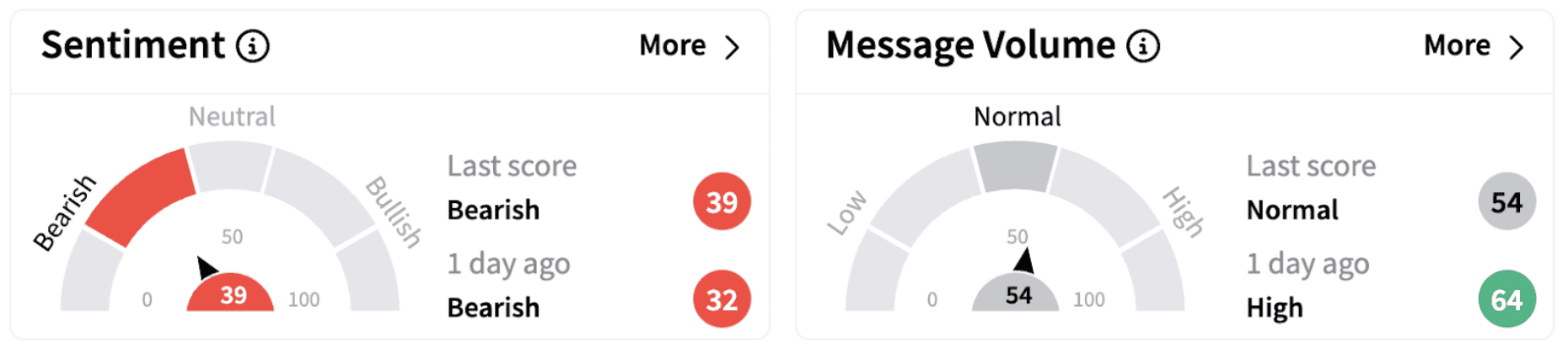

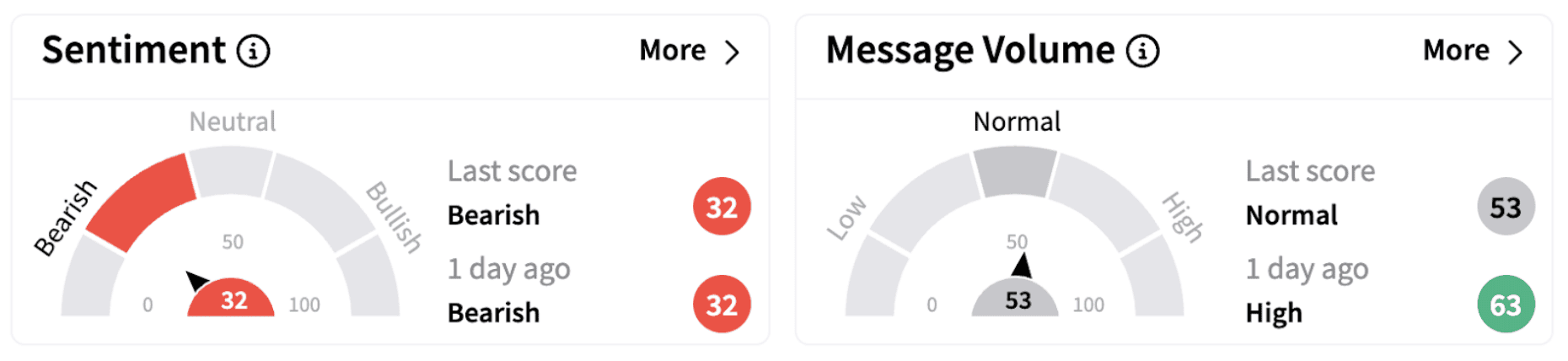

Meanwhile, major Wall Street indices commenced the week on a strong note. The SPDR S&P 500 ETF Trust (SPY) traded 0.7% higher, while the Invesco QQQ Trust, Series 1 (QQQ) rallied over 1% on Monday. However, retail sentiment for these ETFs trended in the ‘bearish’ territory on Stocktwits.

The SPY gained over 3.5% in 2025, while the QQQ rose nearly 4% in the same period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)