Advertisement|Remove ads.

Power Finance Shares: SEBI RA Deepak Pal Sees Buying Interest Near ₹400 Despite Short-Term Weakness

Shares of Power Finance Corporation (PFC), a Maharatna PSU, have been trading in a range over the past couple of weeks.

On the weekly chart, the stock is seen to be in a consolidation phase and is showing signs of struggle. A mild recovery followed a low of ₹388.60 on June 19, but the overall trend remains corrective, according to SEBI-registered analyst Deepak Pal.

On the daily chart, however, the stock is taking firm support at its 14-day and 55-day exponential moving averages (EMA), suggesting buying interest at lower levels. The stock had reached a low of ₹382.50 on May 9, which triggered a steady upward move before the current consolidation began, Pal said.

On June 27, it opened at ₹424.00, dipped to ₹419.25, reached a high of ₹427.80, and closed at ₹421.55, indicating indecision among market participants.

Currently, the stock is trading within the range of its 14-day and 200-day EMAs on the daily chart, and between its 14-day and 55-day EMAs on the weekly chart.

Despite short- to medium-term weakness, the analyst views the ₹400 level as a critical support zone, and pullbacks around the stock price could offer a favorable entry point.

Fundamentally, the NBFC is in a strong position, delivering a record consolidated net profit of ₹30,514 crore in FY 2025. Total income surged to ₹1.07 lakh crore for the year, with a 12% expansion in the loan book, which crossed ₹11.1 lakh crore. Asset quality strengthened significantly, with net NPA falling to 0.38%.

Motilal Oswal issued a bullish view on PFC last week, assigning a ‘buy’ rating with a target price of ₹485.

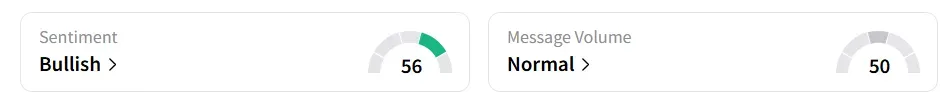

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier.

Year-to-date, the stock has shed 5.9%

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263711678_jpg_7dcbe85e4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202237165_jpg_188d67bdb5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_2_jpg_0c6789db95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263736058_jpg_2b8f901978.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298120_jpg_ceb8c90666.webp)