Advertisement|Remove ads.

Priti International Eyes Breakout As Technical Charts Hint At A Reversal: SEBI RA Rajneesh Sharma

Priti International is signaling a potential trend reversal, supported by multiple bullish divergences and a robust technical structure.

The On-Balance Volume (OBV) reveals a bullish divergence, noted SEBI-registered analyst Rajneesh Sharma. While the stock price has been making lower lows, OBV has been forming higher lows, hinting at accumulation.

The Relative Strength Index (RSI) is forming higher lows from oversold levels, indicating that bullish momentum is gradually strengthening. The Money Flow Index (MFI) is also on an upward trend, reflecting renewed buying interest, he added.

Weekly volumes remain steady around 5.96 million shares, indicating that selling pressure has likely reduced. Price action indicates consolidation between ₹93 and ₹95, suggesting a base formation.

If Priti International stock manages a sustained move above the ₹100 mark, it will lead to a stronger uptrend, Sharma said.

At the time of writing, the shares were 0.8% higher at ₹93.42.

Strong fundamentals reinforce Priti’s technical setup, Sharma added. The company, which operates in textile, wooden, and iron handicraft segments, is debt-free.

Priti has been focusing more on domestic growth, institutional orders, and new segments, including PriAuction (auction business) and solar trading. Its institutional clients include CRPF (Central Reserve Police Force), Rashtrapati Bhavan, and the Indian Navy, among others.

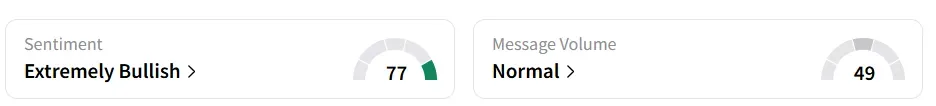

On Stocktwits, retail sentiment remained ‘extremely bullish’.

The stock has been under heavy selling pressure, having lost over a third of its value year-to-date (YTD). However, technical signals indicate a reversal is on the cards.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)