Advertisement|Remove ads.

Priya Nair To Become HUL’s First Woman CEO: Stock Rallies On Leadership Switch Ahead Of Q1 Earnings

Hindustan Unilever (HUL) shares surged 5% on Friday, as the street cheered leadership changes at the fast-moving consumer goods giant. For the week, the stock has gained nearly 10%.

The company has appointed Priya Nair as the new Managing Director (MD) and Chief Executive Officer (CEO), effective Aug. 1. This elevation makes Nair the first woman to lead HUL. She succeeds Rohit Jawa, who will step down from the top post on July 31.

Currently, as the President of Beauty & Wellbeing at Unilever, London, Nair is responsible for a €13 billion portfolio that ranges across hair care, skin care, prestige beauty, health, and wellbeing brands in 20 countries.

SEBI-registered analyst Financial Independence noted that the positive stock reaction reflected strong investor confidence. He added that analysts expect renewed growth momentum, especially in Beauty and Home Care segments under her leadership.

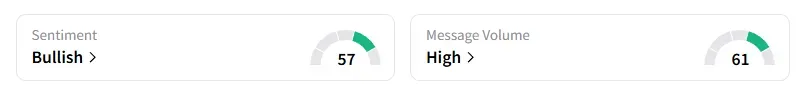

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter amid ‘high’ message volumes.

Meanwhile, as the earnings season gets underway, all eyes will be on HUL when it reports its first-quarter earnings (Q1 FY26). HSBC believes HUL may begin to show the impact of its renewed focus on volume growth over margin.

They expect volume growth of 3% in Q1, reflecting underlying demand weakness, but do see them improving gradually over the second half of the year. EBITDA margins are likely to remain between the 22-23% guidance provided in Q4.

HUL shares have risen 8% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)