Advertisement|Remove ads.

Prologis Tops Q1 FFO Estimates, CEO Says Policy Uncertainty Making ‘Customers More Cautious’

Prologis stock garnered retail attention on Wednesday after topping Wall Street’s estimates for quarterly funds from operations (FFO).

According to FinChat data, the warehouse-focused real estate investment trust (REIT) reported core FFO of $1.42 per share for the first quarter, while analysts expected it to report $1.38 per share. This metric gauges REIT profitability.

The company reported total revenue of $2.14 billion for the quarter ended March 31, compared with $1.96 billion a year earlier.

Its net earnings of $0.63 per share for the first quarter were unchanged from the year-ago quarter.

"We delivered exceptional results this quarter—signing leases totaling 58 million square feet, breaking ground on new build-to-suits with strategic customers and expanding our power capacity to support the growing demand for data centers," said Dan Letter, president of Prologis.

The company ended the quarter with an occupancy rate of 95.2% compared with 97% in the year-ago quarter.

"In the near term, policy uncertainty is making customers more cautious. But over the long term, limited new supply and high construction costs support continued rent growth,” said CEO Hamid Moghadam.

Inventory levels will increase as businesses stockpile and build resiliency, the company said.

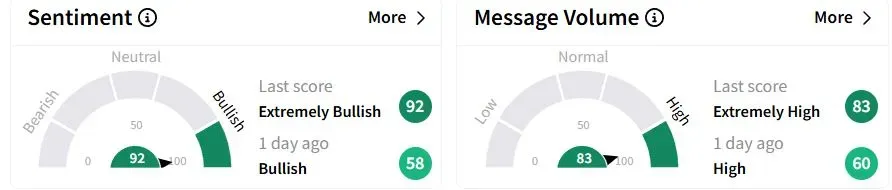

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (92/100) territory from ‘bullish’(58/100) a day ago, while retail chatter was ‘extremely high.’

One retail investor noted that the stock was trading about 40% lower compared to all-time highs, while dividends were near a decade high.

Prologis shares have fallen 5.7% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)