Advertisement|Remove ads.

QXO Stock Slips Premarket On Equity Offerings, Retail Keeps Faith In CEO Brad Jacobs

QXO Stock fell 7.6% in premarket trading on Wednesday after the company launched concurrent offerings of common stock and depositary shares.

The building materials company expects to raise $1 billion from the offering, which it intends to use to reduce its debt and strengthen its position for new acquisitions.

The company said that Goldman Sachs & Co. and Morgan Stanley are acting as lead joint bookrunning managers for the offerings.

QXO also said it intends to grant the underwriters of both offerings options to buy additional shares worth up to $150 million.

Last month, the billionaire Brad Jacobs-led firm sold nearly 38 million shares to raise the funds for its acquisition of Beacon Roofing.

QXO acquired Beacon for $124.35 per share in cash, a deal valued at $11 billion including debt.

The companies had been in talks for several months after Beacon rejected an initial bid in November, citing that the deal undervalued the company. This had prompted QXO to launch an open tender offer and nominate 10 independent directors to Beacon’s board.

“We intend to make QXO very big as quickly as possible,” Jacobs had told the Wall Street Journal.

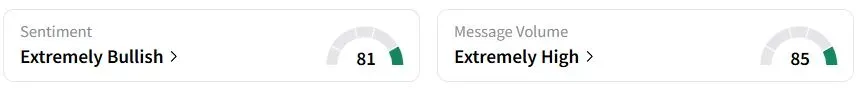

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (82/100) territory, while retail chatter was ‘extremely high.’

QXO’s Sentiment Meter and Message Volume as of 5:02 a.m. ET on May 21, 2025 | Source: Stocktwits

“Shares are already solidly above $17 tonight. This dip doesn’t appear like it’ll last long,” one user said.

“Remember, this is a Brad Jacobs acquisition engine. His acquisitions are all about great people and shareholder value. Investors will view the current price dip as an opportunity,” another investor said.

QXO stock has gained 14.7% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)