Advertisement|Remove ads.

Rambus Shares Surge Amid Wave Of Price Target Hikes, Analysts Call It A ‘Unique Stock’ With ‘Offensive’ Characteristics: Retail Sentiment Soars

Shares of Rambus Inc. (RMBS) surged more than 7% in mid-day trade on Tuesday, following a flurry of price target hikes from brokerages following the company’s fourth-quarter results.

Rambus posted earnings per share of $0.58 on record quarterly revenue of $161.1 million. While EPS aligned with analyst estimates, according to Stocktwits data, the company edged past the estimated revenue of $160.3 million.

The firm posted a 9.4% rise in EPS and an almost 32% surge in revenue year over year.

Rambus is a Sunnyvale, California-based company that designs, develops, and licenses chip interface technologies.

The company’s fourth-quarter performance and first-quarter guidance drew in a slew of price target upgrades from brokerages, according to The Fly.

While Susquehanna and Wells Fargo hiked their price targets for the Rambus stock to $70 and $73, respectively, Evercore initiated stock coverage with an ‘Outperform’ rating.

Susquehanna and Wells Fargo analysts underscored potential EPS expansion of $3 to $4, thanks to positive secular trends across product categories.

Here are the latest ratings from brokerages:

- Susquehanna: Price target raised to $70 from $66, with a ‘Positive’ rating.

- Wells Fargo: Price target raised to $73 from $62, with an ‘Overweight’ rating.

- Evercore ISI: Price target of $71, with an ‘Outperform’ rating.

- Baird: Price target of $90, with an ‘Outperform’ rating.

According to Koyfin, the average price target for the Rambus stock is $71.43, implying an upside of 10.4% from current levels.

Analysts at Baird underscored their bullish outlook for Rambus, saying that the chip interface designer is at the center of their 2025 semiconductor investment themes.

In its recent note, Evercore called Rambus “a unique stock within Semis that offers the offensive characteristics of a strong product cycle and defensive characteristics of high free cash flow (FCF) associated with its consistent IP business."

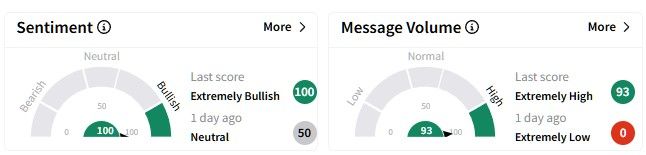

Retail sentiment on Stocktwits around the Rambus stock hit a one-year high, entering the ‘extremely bullish’ (100/100) territory from ‘neutral’ (50/100) a day ago.

Message volume also surged to a one-year high, hovering in the ‘extremely high’ (93/100) zone.

Rambus’ share price has surged more than 56% over the past six months. However, its stock has fallen over 5% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cigna_shares_resized_2250d1271f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250352860_jpg_45946f3f12.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)