Advertisement|Remove ads.

Ray Dalio Warns Of Fiat Trust Breakdown, Says Gold Standard Return Is Possible

Ray Dalio, founder of Bridgewater Associates, said on Tuesday that it’s possible that the U.S. dollar may revert to the gold standard.

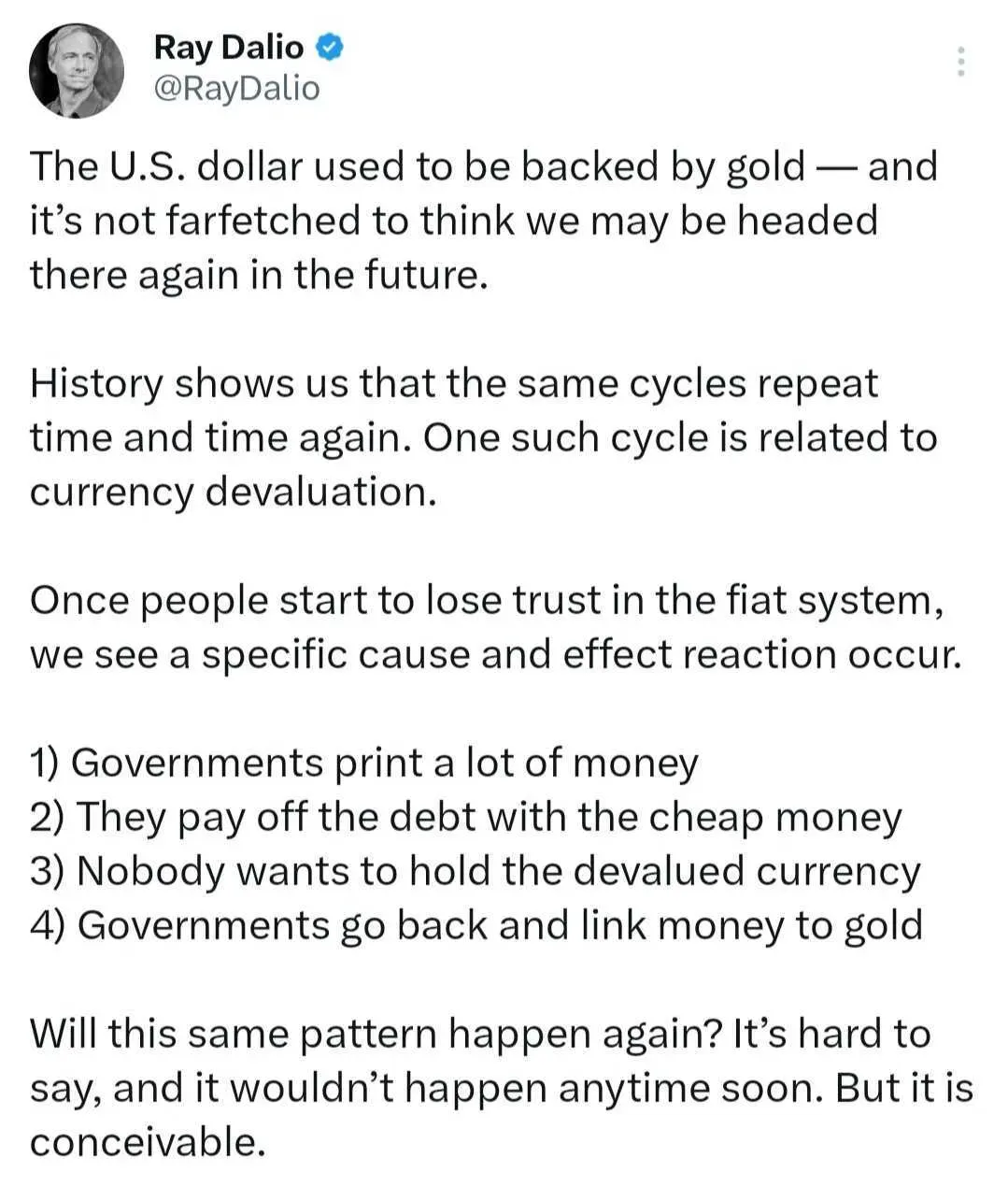

“History shows us that the same cycles repeat time and time again. One such cycle is related to currency devaluation,” Dalio said in a post on X. “Once people start to lose trust in the fiat system, we see a specific cause and effect reaction occur.”

A fiat currency is issued by a government and is not backed by a physical commodity like gold or silver. The U.S. and much of the world switched to fiat from the gold standard back in the 1970s. At the time, the country was facing fiscal issues due to large federal deficits resulting from the Vietnam War. According to Dalio, a switch-back may be on the cards.

U.S. debt stands at $36.2 trillion as of mid-2025, which is around 122% of the country’s annual GDP, and it has been rising rapidly. The U.S. Dollar Index (DXY) had gained 0.25% in morning trade on Tuesday, but it has dropped nearly 8.8% this year and 4.1% over the past 12 months. On Stocktwits, retail sentiment around DXY remained in ‘neutral’ territory over the past day, down from ‘extremely bullish’ a month ago.

Dalio anticipates that governments are likely to print more money and use that money to pay off their current debt. However, since the increase in money supply would devalue the currency, nobody would want to hold onto it anymore. “Governments go back and link money to gold,” he wrote, adding that this would be the final step of the cycle.

Dalio had warned in July that the Moody’s downgrade of the U.S. sovereign credit rating was only the tip of the iceberg. “They don’t include the greater risk that countries in debt will print money to pay their debts, thus causing holders of the bonds to suffer losses from the decreased value of the money they’re getting,” he said.

Read also: Trump Warns EU Of 35% Tariff, Confirms India Hike Within 24 Hours

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)