Advertisement|Remove ads.

Reddit Stock Retreats From Record High On Analyst's Cautious Commentary: Retail Firmly Bullish

Reddit, Inc. (RDDT) shares came under selling pressure Thursday afternoon after an analyst expressed wariness over valuation but retail confidence remained unabated.

Seaport Research initiated coverage of Reddit stock with a ‘Neutral’ rating, TheFly reported. The community-focused social media company’s stock has rallied over 35% this year on top of the 155% gain it collected since its March 22 listing.

The stock ended Wednesday’s session at a fresh intraday high of $221.18 and a closing high of $221.16.

Seaport analysts said the Reddit stock has already discounted continued revenue strength and upside compared to consensus estimates. Therefore, the analysts think the stock is “fairly valued” at current levels.

However, the brokerage is positive on Reddit’s fundamentals. It believes the company has evolved to become one of the internet’s largest user destinations and remains poised to benefit from continued user growth momentum.

Additionally, Seaport said Reddit is an attractive advertising platform with significant monetization opportunities ahead.

Reddit is due to report fourth-quarter earnings results after the market closes next Wednesday. Analysts, on average, expect the company to report fourth-quarter earnings per share (EPS) of $0.25 and revenue of $404.2 million.

In late October, the company reported a surprise profit for the third quarter and also guided to fourth-quarter revenue of $385 million to $400 million and adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) of $110 million to $125 million.

The solid third-quarter results gave the stock a big thrust, which gained further momentum when the company tested Reddit Answers.

The new feature is an artificial intelligence (AI)- driven conversational interface that allows users to ask questions and receive curated summaries of Reddit’s community-driven discussions.

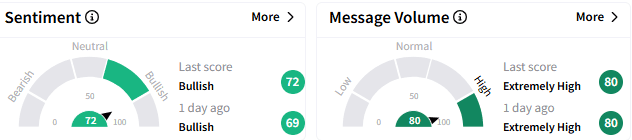

On Stocktwits, sentiment toward Reddit stock turned ‘extremely bullish’ (72/100) from the ‘bullish’ mood seen a day ago, with the message volume remaining at ‘extremely high’ levels.

A platform user said Thursday’s weakness was a good “cool-off” and predicted consolidation going into the fourth-quarter print. They see the stock spiraling higher to $250 after next Wednesday’s earnings. Another user said it is a good time to buy.

Reddit stock was down 2.32% at $215.85 at the last check but the downside has come with below-average volume.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2248926041_jpg_87d77606e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rare_Earth_resized_jpg_e635892f59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_bear_crash_93b71a2ed3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_global_e_online_jpg_d113293502.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2210782299_jpg_f1c47d74a6.webp)