Advertisement|Remove ads.

Trump Media Company Stock Rises On Plans To Offer Bitcoin ETF, Other Thematic Financial Products: Retail Mood Fails To Revive

Trump Media & Technology Group Corp. (DJT) stock rose in afternoon trading on Thursday after the company announced that it has applied to register trademarks for brand names of Truth.Fi investment vehicles.

The Truth Social parent said it plans to offer customized exchange-traded funds (ETFs) and separately managed accounts (SMAs), beginning this year.

The proposed investment vehicles include a “Made in America” ETF, “Made in America” SMA, “Energy Independence” ETF, “Energy Independence” SMA, “Bitcoin Plus” ETF and “Bitcoin Plus” SMA, all under the Truth.Fi brand.

Trump Media & Technology Group (TMTG) said the launch of these investment vehicles is part of its financial services and FinTech strategy that includes investment up to $250 million.

Charles Schwab Corp. (SCHW) would act as the custodian and partner with TMTG to develop the SMAs.

TMTG also said it has signed a services and licensing agreement with an affiliate of Yorkville Advisors, which will act as the Registered Investment Advisor (RIA) for the new financial vehicles.

CEO and Chairman Devin Nunes said, “We aim to give investors a means to invest in American energy, manufacturing, and other firms that provide a competitive alternative to the woke funds and debanking problems that you find throughout the market.”

The company is exploring ways to differentiate its products, including strategies related to bitcoin, he added.

The move assumes importance as President Donald Trump is favorably disposed toward digital currencies. Just ahead of its inauguration, the president launched a memecoin called Trump coin (TRUMP.X).

The announcement from TMTG has not lifted Bitcoin (BTC.X), which traded down 0.78% over the past 24 hours at a little over $96.7K, off its all-time high of $109.11K.

However, TMTG stock, which initially showed muted reaction to the announcement, took off and last traded up 4.55% at $31.73. The upside has been accompanied by below-average volume.

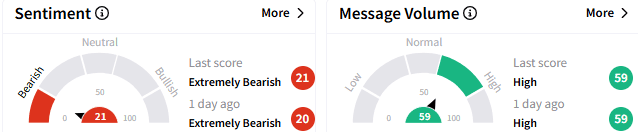

On Stocktwits, retail sentiment toward TMTG stock remained ‘extremely bearish’ (21/100) although message volume was ‘high.’

Much of the backlash toward the stock on the platform was due to negative opinions regarding the Trump regime and the man per se.

One user commented that the stock will likely fall below $25.

TMTG stock has shed 11% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Lightspeed Commerce Stock Plunges Despite Q3 Beat But Retail’s Impressed With Buyback Plan

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)