Advertisement|Remove ads.

Reddit Slips After-Hours Amid Insider Transactions: Retail Now Eyes Buying The Dip

Reddit, Inc. (RDDT) stock extended its fall in Monday’s after-hours session as investor skepticism toward the community-driven social media company abounds amid the engulfing macroeconomic uncertainty.

Late Monday, regularity filings from the San Francisco, California-based company showed insider transactions in the beaten-down stock.

A Form-4 report showed that J.D. Power CEO David Habiger, who serves as the Chair of Reddit’s board, bought 780 shares of the social media company last Thursday at a weighted average price of $126.07.

Following the purchase, Habiger owned about 31,588 Reddit shares.

Habiger had purchased 774 shares last Wednesday

In a Form 144 filing, Reddit disclosed that COO Jennifer Wong would sell 100,000 shares, with the approximate date of the transaction mentioned as March 17.

The aggregate market value of the shares is $12.82 million.

Earlier this year, Wong sold an aggregate of 66,667 Reddit shares under the 10b5-1 trading plan.

Form 4, commonly called an insider trading report, should be filed by insiders when they buy or sell shares. The SEC defines an insider as certain executives, such as officers and directors, and anyone who owns more than 10% of the outstanding shares of a publicly traded company.

On the other hand, Form 144 is called a “notice of proposed sale of securities,” and it must be filed when the shares in question exceed $50,000 in value or 5,000 units. The report is often filed when the shares are offered for sale and the sale must take place within 90 days of the filing.

Reddit noted in the Form 144 filing that the securities earmarked for sale were and will be received upon the exercise of stock options over the next three months.

Reddit stock fell 2.07% on Monday after Redburn Atlantic initiated coverage with a ‘Sell’ rating and a $75 price target, citing valuation concerns.

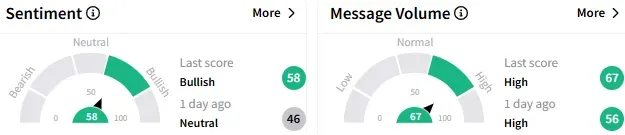

On Stocktwits, retail sentiment toward Reddit stock improved to ‘bullish’ (60/100) from the ‘neutral’ mood that prevailed a day ago. The message volume stayed at ‘high’ levels.

A bullish watcher positioned for a rebound by Reddit stock this week.

Another user questioned Redburn Atlantic’s sell recommendation as Google expanded Reddit’s ability to garner new users through its search engine.

Reddit stock is down over 23% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Microcap AirNet Stock Nearly Doubles On Kazakhstan Bitcoin Mining Deal, Retail Buzz Explodes

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)