Advertisement|Remove ads.

Reddit Stock Slips Premarket After 4-Session Slide — But Here’s Why Retail Traders Are Still Optimistic

Community-based social-networking company Reddit, Inc.’s (RDDT) shares are down over 1% in the early premarket session on Thursday, following losses in each of the last four sessions.

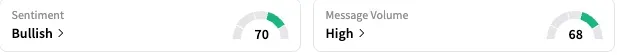

Retail traders, however, remained optimistic, with sentiment toward the Reddit stock staying ‘bullish’ (70/100) as of early Thursday. The message volume on the stream was at ‘high’ levels.

Thursday’s premarket weakness stemmed from investors' caution regarding the slew of economic data scheduled for release during the day. They also took stock of two separate regulatory filings related to insider sales.

Chief Operating Officer Jennifer Wong sold 39,208 Class A common stock in a series of transactions done on Sept. 22. The company clarified in the filing that the transactions were planned sales and were done pursuant to the Rule 10b5-1 trading plan adopted by Wong on May 16. Chief Technology Officer and co-founder Christopher Slowe also exercised the options vested on him and sold the underlying shares in a series of transactions on the same day

A bullish watcher said insider sales have been dragging the stock in recent sessions, but expressed confidence that the stock will reverse course if Thursday’s jobless claims data come in benign.

Another user predicted a short-squeeze rally following Reddit’s recent lean run.

According to Koyfin data, the short interest percentage for the stock is 10.50%. Reddit stock has gained 44% year-to-date. Since hitting a bottom of $79.75 on April 7 amid the sell-off triggered by Trump tariffs, the stock has added nearly 200%.

Wall Street analysts, on average, have a 12-month price target of $216.73 for the Reddit stock, implying 8% downside from Wednesday’s closing level.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)