Advertisement|Remove ads.

Reliance Stock Gains As Jio Hikes Entry Tariffs, FMCG Arm Expands Into Beverages

Shares of Reliance Industries gained more than 2.6% on Tuesday as investors cheered two key business developments: its FMCG arm’s foray into the herbal beverages segment through a new joint venture, and Jio’s tariff revision that makes 1.5GB/day the new entry-level plan.

Why Has The Stock Gained?

After market hours on Monday, Reliance announced that its FMCG arm, Reliance Consumer Products Ltd (RCPL), acquired a majority stake in a joint venture with Naturedge Beverages Pvt Ltd. The move marks Reliance’s foray into the fast-growing healthy functional beverage market. RCPL will offer consumers a range of herbal-natural beverages, according to an official press release.

In a separate development, Reliance’s telecom arm and India’s largest operator Jio has scrapped its entry-level 1 GB/day plans priced at ₹249 for 28 days, making 1.5 GB/day packs the new starting option. Following the revision, the effective entry plan now starts at ₹299 for 1.5GB per day for 28 days, up from ₹249.

The move is aligned with the pricing offered by Bharti Airtel and Vodafone Idea.

Brokerages Take

According to reports, IIFL noted that Jio’s ₹249 pack contributed less than 10% to mobile revenues, and the recent 20% tariff hike may lift overall revenue by under 2%. In contrast, Axis Capital expects the changes to drive a 4–5% increase in Jio’s FY26E revenue and ARPU.

Domestic brokerages have reiterated a ‘Buy’ rating on Reliance, with a target price of ₹1,690.

Citi highlighted that SEBI’s proposal on large IPOs could have significant positive implications for a potential Jio listing. Jefferies also maintained its ‘Buy’ call with a target of ₹1,670, pointing to stronger cash flows from Jio, steady retail growth, and ongoing renewable investments in the oil-to-chemicals segment.

Retail Sentiment Buoyant

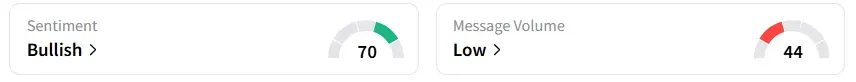

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a week ago.

The company posted a 78% increase in Q1 net profit at ₹26,994 crore, while operational income increased by 5.3% to ₹2,48,660 crore. Jio Platforms, which runs Reliance Jio Infocomm, reported a net profit of ₹7,110 crore in the April-June quarter, up 24.9%.

Year-to-date (YTD), the stock has gained over 16%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)