Advertisement|Remove ads.

Unity Software, Baidu And Banzai: 3 Tech Stocks That Drew Loudest Retail Chatter Over Past 24 Hours

The U.S. market is set to start the fresh trading week on a downbeat note as risk-off sentiment dominates amid the engulfing geopolitical and macroeconomic uncertainties.

Amid the souring sentiment, the following stocks saw a spike in retail chatter for the 24-hour period ending late Sunday:

Banzai International Inc (BNZI) — 1,200% increase in message volume

Bainbridge Island, Washington-based Banzai is a provider of data-driven marketing and sales solutions for various businesses across the globe.

Its products include Demino, a browser-based webinar platform, Boost, a software-as-a-service (SaaS) solution for social sharing by event registrants, and Reach, a SaaS and managed service to increase registration and attendance of marketing events.

Last week, the company reported 20.1% year-over-year (YoY) revenue growth for the fourth quarter but a wider net loss of $7.9 million.

The company was also a presenter at the 80th Emerging Growth Conference on Thursday.

Banzai stock ended Thursday’s session down 0.36% at $1.0562 but posted a weekly gain of 2.5%. The nano-cap stock is down over 30% this year.

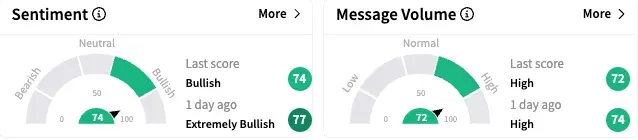

On Stocktwits, retail sentiment toward Banzai stock was ‘bullish’ (74/100) by late Sunday, although down from the ‘extremely bullish’ mood a day ago. The message volume also trickled down to ‘high’ levels.

One bullish watcher said the company has extraordinary annualized recurring revenue growth.

Unity Software, Inc. (U) — 700% increase in message volume

San Francisco, California-based Unity Software offers a suite of tools for creating and marketing games and interactive experiences across devices.

Unity Software stock climbed 1.80% to $19.23 on Thursday and ended flat for the week. The stock has lost 14.4% since the start of 2025.

Thursday’s strength came after the company announced that it would report its results for the first quarter of the fiscal year 2025 on May 7.

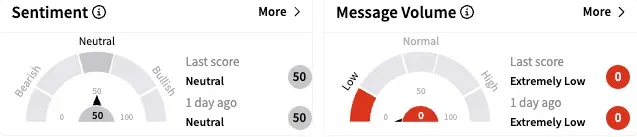

Retail sentiment toward Unity Software stock was ‘neutral’ (50/100) late Sunday.

A watcher anticipated some news, citing bullish options flow.

On the other hand, another user said the macroeconomic conditions could drag the stock toward the $12 level.

Baidu, Inc. (BIDU) — 600% increase in message volume

Beijing-based Chinese search giant Baidu, Inc. (BIDU) ended Thursday’s session down 0.11% at $82.59. The stock gained 1.07% in the early premarket session on Monday.

The retail chatter about the stock gained steam on Stocktwits following some strong data released by China last week. The country reported better-than-expected first-quarter GDP growth and strong retail sales data for March.

Another user said he expects Baidu stock to take off to $100 in the coming sessions either on good news or stabilization of the market.

Baidu stock is down merely 2% year-to-date, versus the steeper 13% drop by the Invesco QQQ Trust (QQQ).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)