Advertisement|Remove ads.

Retail Investors Embrace Bull Market: Stocktwits Poll Reveals Majority Opt To Buy More Or Hold

With risk appetite returning to the market following the reprieve offered by the China trade deal, retail investors have shown renewed interest in plunging deeper into the stock market.

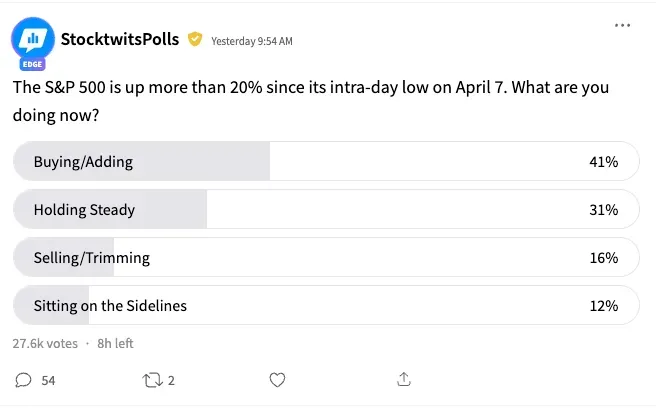

An ongoing Stocktwits poll probed users regarding what they were doing in the wake of the broader S&P 500 Index's 20% recovery from the April 7 post-tariff lows. The poll received responses from over 27,000 users.

Nearly three-fourths (72%) said they accumulated shares or held steady, with 41% buying and 31% holding their positions steady.

Only 16% said they sold or trimmed their positions and a more modest 12% said they waited on the sidelines.

Among the users who elaborated on their actions, one said they bought when the S&P 500 hit its low, adding, "It is now time to enjoy the new gains!"

Another user said they picked up individual stocks that they thought would do well, but not index funds. "Best to buy indexes if dollar cost averaging or when there's a semi-clear bottom," they said.

But those in the bearish camp fretted about the continuing uncertainty. A watcher said, "There's still another 90-day deadline for tariffs, so once again, the government has made everything uncertain."

Another user said they expected the market to test the April bottom in the next quarter.

Strategists and analysts are divided. Morgan Stanley Chief Investment Officer Lisa Shalett highlighted the U.S. debt, political uncertainty, and global instability as key near-term headwinds, dousing investor hopes for a new bull market.

Against this backdrop, the strategist recommended that investors consider maximum portfolio diversification by asset classes, sector, and region. She also advised investing in an equal-weighted S&P 500 Index or actively picking securities with attractive qualities, such as quality growth stocks with achievable earnings targets.

WisdomTree Senior Economist Jeremy Siegel said he remains 'long-term bullish' on equities. He preferred dividend-paying stocks that stand to benefit from rate cuts rather than speculative growth sectors.

Given the abounding uncertainties, the Federal Reserve, under Chair Jerome Powell, remains wary of any preemptive move. According to the CME FedWatch tool, most futures traders currently anticipate a rate cut only in September.

Siegel said investors should brace for some volatility in the near term. Even if tariffs are partially rolled back, he sees some earnings damage and a slow road to recovery in corporate margins.

The S&P 500 Index, which peaked at 6,147.43 (intraday) on Feb. 10, pulled back, with the sell-off intensifying after President Donald Trump announced his Liberation Day tariffs on April 2.

After hitting a low of 4,835.04 on April 7, the index has staged a recovery. Thanks to a three-session advance through Wednesday, the index has wiped away the losses for the year. From the April 7 trough, it is now up about 22%.

Technically, we are in a new bull market - defined as a rise of 20% or more from a recent low.

The resurgence comes from the U.S. trade deal with China, softer-than-expected April inflation data, and the billions of dollars of Middle East contracts artificial intelligence (AI)-leveraged companies bagged, coinciding with Trump's visit to the region.

So far this year, the Invesco QQQ Trust (QQQ) ETF and the SPDR S&P 500 ETF (SPY) are up 1.6% and 0.6%, respectively.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: DXC Tech Stock Slides On Sour Guidance, But Retail's Happy As Q4 Results Top Estimates

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_OG_jpg_9d414a2458.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)