Advertisement|Remove ads.

Retail Investors Stay Bullish On Cruise Lines Despite Potential Trump Tax Threat

Shares of several cruise operators dived on Thursday following comments from Commerce Secretary Howard Lutnick about potential new taxes on cruise lines, but retail sentiment stayed upbeat.

Shares of Royal Caribbean Cruises (RCL) dipped more than 7%, while Norwegian Cruise Line (NCLH) saw more than 4% fall in its stock; Carnival Corp (CCL) also dropped nearly 6% on Thursday.

According to media reports, the US federal government is mulling taxes that will be slapped on cruise operators.

Royal Caribbean and several other cruise lines have reported better-than-expected earnings in recent weeks, driven by strong post-Covid demand and attractive prices.

“This is going to end under Donald Trump and those taxes are gonna be paid,” Quartz reported quoting Lutnick who spoke to Fox News.

Sentiment on Stocktwits around cruise operator stocks remained ‘bullish’ despite the stock dip.

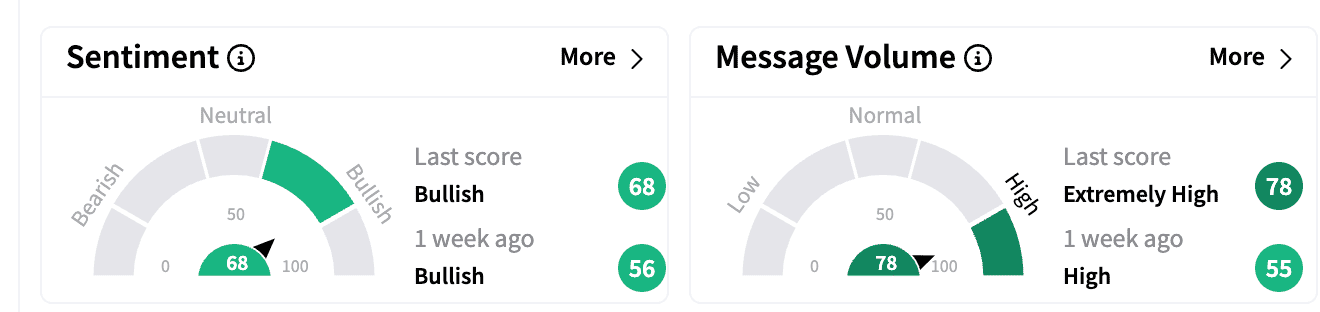

Royal Caribbean’s retail mood remained ‘bullish’ as message volumes jumped to ‘extremely high.’

One bullish commenter on Stocktwits doubted if the tax plan would in fact go through, saying “goodluck with the tax plan on cruise lines."

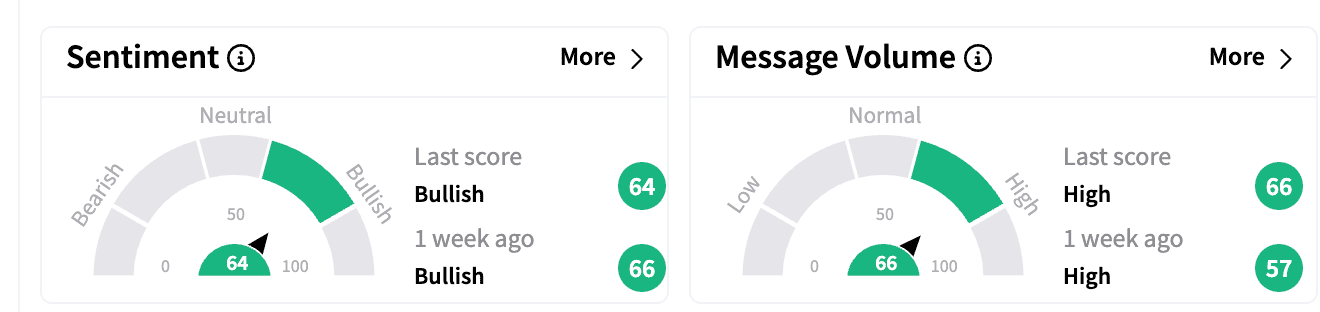

Sentiment on Carnival stayed in the ‘bullish’ zone, with 'high' message volume compared to a week ago.

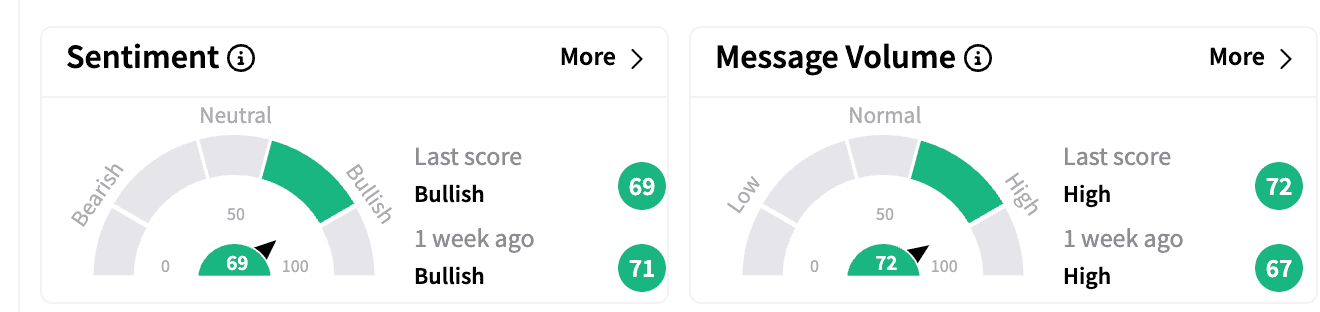

Sentiment on Norwegian Cruise Line also was in the ‘bullish’ zone, with message volume staying 'high.'

One bullish commenter was optimistic about the idea of buying the dip in Norwegian Cruise Line.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)