Advertisement|Remove ads.

MYTE, APD, NAPA: Retail Investors Most Bullish On These 3 Stocks Pre-Market

As U.S. stock futures saw a slight rebound on Tuesday ahead of key inflation data due later this week, these three stocks captured the attention of retail investors pre-market, according to Stocktwits.

MYT Netherlands Parent B.V. (MYTE)

The parent company of Germany-based luxury online retailer Mytheresa surged in retail interest after announcing its acquisition of Richemont’s eCommerce platform Yoox Net-a-Porter (YNAP).

In exchange for 100% of YNAP’s share capital, Richemont will gain a 33% stake in Mytheresa, with YNAP bringing €555 million ($608 million) in cash and no debt. Mytheresa will also receive a €100 million revolving credit facility from Richemont.

Jefferies said it sees this as a “meaningful” opportunity for Mytheresa to enhance YNAP’s operations and build a stronger global luxury eCommerce platform, though they note execution risks and near-term pressures from industry-wide discounting. The brokerage maintained a ‘Hold’ rating with a $4 price target.

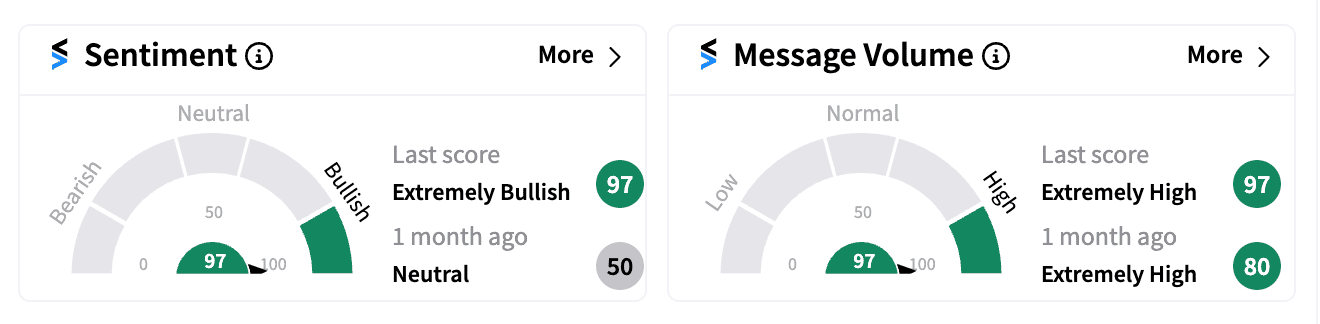

On Stocktwits, sentiment for MYTE was ‘extremely bullish’ (97/100) as of 7:30 a.m. ET, despite shares being down nearly 2% pre-market.

Air Products and Chemicals, Inc. (APD)

Shares of industrial gas giant Air Products surged 9.5% on Monday after reports indicated that activist investor Mantle Ridge has taken a $1 billion stake in the company. The investment firm is expected to push for changes in APD’s capital allocation and succession plans.

Jefferies upgraded the stock to ‘Buy’ from ‘Hold’ and raised the price target to $364 from $295.

Analyst Laurence Alexander believes the activist involvement could refocus Air Products’ narrative towards “quality growth” and boost shareholder returns.

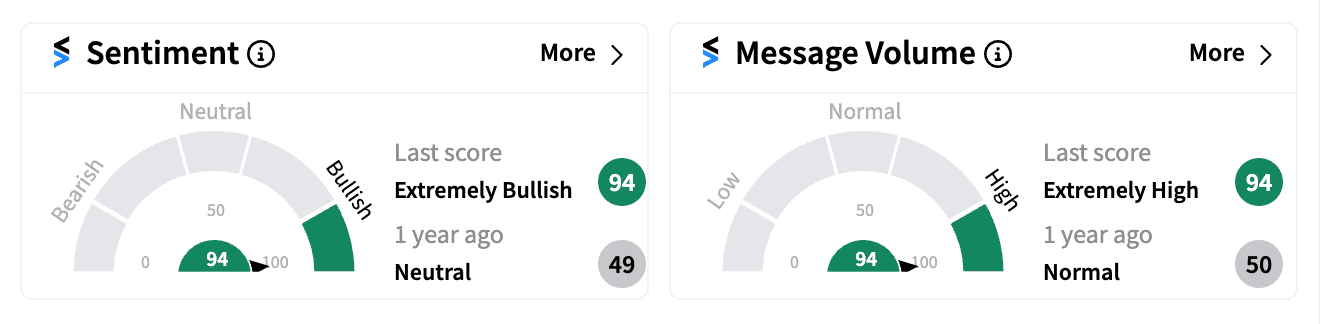

Retail sentiment for APD was ‘extremely bullish’ (94/100) on Stocktwits, while the stock was down just 0.2% pre-market.

Duckhorn Portfolio Inc. (NAPA)

Shares of luxury winemaker Duckhorn Portfolio more than doubled on Monday after it announced a $1.95 billion take-private deal with private equity firm Butterfly Equity.

Additionally, the company’s quarterly profit surpassed analyst expectations, further fueling investor enthusiasm.

Following the news, BMO Capital raised the price target to $11 from $9, while Barclays lifted it from $6 to $11, both maintaining ‘neutral' ratings.

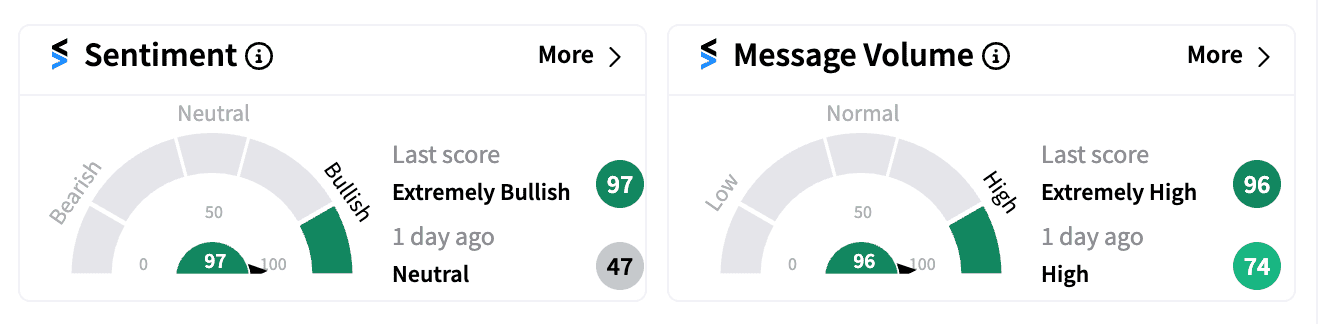

On Stocktwits, sentiment for NAPA was ‘extremely bullish’ (97/100) as of 7:30 a.m. ET, with the stock holding flat pre-market.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263711678_jpg_7dcbe85e4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202237165_jpg_188d67bdb5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_2_jpg_0c6789db95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263736058_jpg_2b8f901978.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298120_jpg_ceb8c90666.webp)