Advertisement|Remove ads.

Retail Raves About IQVIA Holdings After Firm Raises Revenue, Profit Guidance

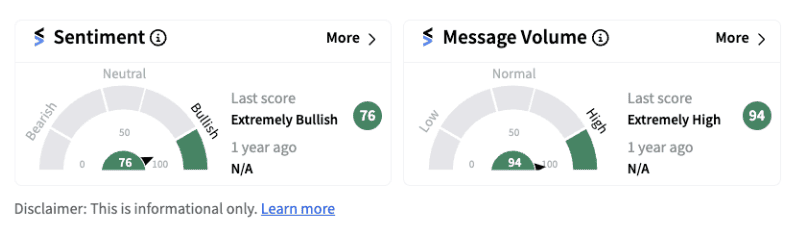

IQVIA Holdings Inc, on Monday, reported an upbeat set of earnings that topped Wall Street estimates while also raising its revenue and earnings per share (EPS) guidance for 2024. Following the announcement, shares of the firm jumped nearly 7% and retail sentiment entered extremely bullish territory (76/100) from a neutral zone supported by extremely high message volumes.

The firm, which provides advanced analytics, technology solutions, and clinical research services to the life sciences industry, reported a 2.30% year-over-year (YoY) rise in its second quarter revenue at $3.81 billion which stood higher than a Street estimate of $3.79 billion. Net income rose 22% YoY to $363 million during the quarter. The firm reported an adjusted diluted EPS of $2.64 as compared to a Street estimate of $2.57.

IQVIA Holdings pointed out that as of June 30, 2024, Research & Development Solutions (R&DS) contracted backlog (including reimbursed expenses), stood at $30.60 billion–growing 7.70% year-over-year and 8.10% at constant currency. The company said it expects approximately $7.80 billion of this backlog to convert to revenue in the next twelve months.

Ari Bousbib, chairman and CEO of IQVIA said the firm delivered second quarter results at the high-end of its guidance, driven mainly by better-than-expected Technology & Analytics Solutions (TAS) performance. TAS revenue came in at $1.49 billion, registering an increase of 2.70% on a reported basis and 3.80% on a constant currency basis.

The company has updated its full-year 2024 guidance for revenue to be between $15.43 billion and $15.53 billion, as compared to an earlier guidance of $15.33-15.58 billion. Adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) is expected between $3.71 billion and $3.77 billion, compared with an earlier guidance of $3.70-3.80. Adjusted diluted EPS is estimated between $11.10 and $11.30 compared with an earlier guidance of $10.95-11.25.

One Stocktwits user named ‘Wigglyick’ has expressed optimism on the technical pattern formed by the stock, which other users cited as evidence of its improving fundamental picture.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Goldman_Sachs_resized_c6a47f630c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)