Advertisement|Remove ads.

Retail's Bearish Sentiment On Tesla Aggravates Even As Stock Extends Post-Earnings Rally

Tesla, Inc. ($TSLA) shares are on an extended run, tacking onto the near 22% rally seen on Thursday in reaction to its better-than-expected quarterly results.

The follow-through buying may partly be attributed to positive analysts’ actions. Analysts at Stifel and Piper Sandler raised their price targets for the stock and Phillip Securities upgraded the stock from ‘Sell’ to ‘Reduce,' according to the Fly.

Prominent Tesla bull Cathie Wood’s Ark Invest used Thursday’s strong rally to take profits as the firm offloaded 85,446 shares valued at over $22 million. Notwithstanding the disposal, Tesla continues to be the top holding of Ark’s flagship Ark Innovation ETF ($ARKK), with a15.13% weight.

Much of the investor optimism is due to the better-than-expected third-quarter core auto gross margin and management’s bullish 2025 outlook for the core electric-vehicle business, according to fund manager Gary Black.

“TSLA’s best stock performance in a decade ($TSLA +21.9% yesterday) was due to auto gross margin improvement (17.1% vs 14.9% consensus) and Elon’s bullish FY’25 outlook in its core EV business (+20-30% deliv[ery] growth vs +13.6% consensus) rather than progress in autonomy or robots,” he said in a post on social-media platform X.

Following the third-quarter earnings call, Morgan Stanley’s Adam Jonas said he sees an underlying focus on lowering vehicle cost of goods sold per unit and scaling the in-house battery/energy storage business.

“As investors struggle with the business model shift from auto to AI, this print reminds us growing the auto business profitably remains a high priority,” he said.

With Thursday’s rally, the valuation is stretched. The stock now trades at a forward price/earnings (P/E) ratio of 85.47, according to Yahoo Finance, which is exorbitantly pricey if one considers only its auto business. All the other sum-of-the-parts such as robotics and full self-driving might take a long time to fructify.

Tesla’s robotaxi, when it is operational, will have a tough ask of competing with the rest in the industry such as Alphabet, Inc.’s ($GOOGL) Waymo, which have had a head start.

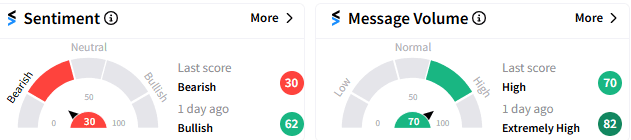

Sentiment toward Tesla on Stocktwits has flipped from being ‘bullish’ on Thursday (65/100) to ‘bearish (30/100), with message volume tapering off slightly. Tesla was the top-trending stock on Stocktwits.

Some in the retail community see Tesla’s two-day rally as a “pump-and-dump.”

At 12:25 pm ET, Tesla stock rallied 2.73% to $267.67 and if it manages to hold the gain till the close, it would end at its highest level in a little over a year.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Biotech_lab_research_4e46efbd94.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nuburu_jpg_20bd1efa23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147544_jpg_6b4f358800.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195701587_jpg_dde6526b92.webp)