Advertisement|Remove ads.

Retail Traders Prefer Novo Nordisk To Eli Lilly After Medicare Shuts Door On Obesity Drug Coverage — But There's More

Shares of Novo Nordisk ended higher on Monday and extended gains in after-hours trading, while "Big Pharma" rival Eli Lilly fell nearly 2% and continued slipping after the closing bell.

The diverging stock moves followed the Trump administration's decision late on Friday to halt a proposal to allow the federal health insurance program Medicare to cover high-demand weight-loss drugs.

The Associated Press reported that the Centers for Medicare and Medicaid Services left out a Biden administration proposal to cover anti-obesity drugs in its final 2026 Medicare Part D rule.

The report also noted that Trump's Health and Human Services secretary, Robert F. Kennedy Jr., has been a vocal critic of the popular injectables despite their growing use for significant weight loss benefits.

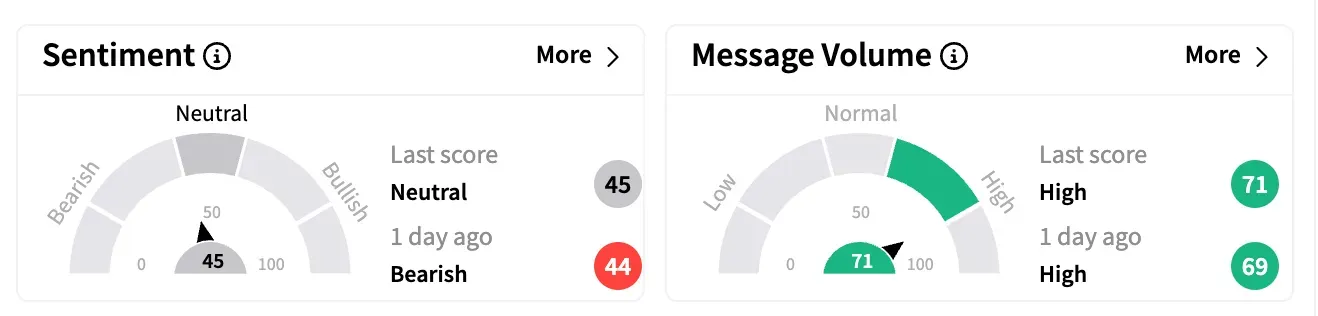

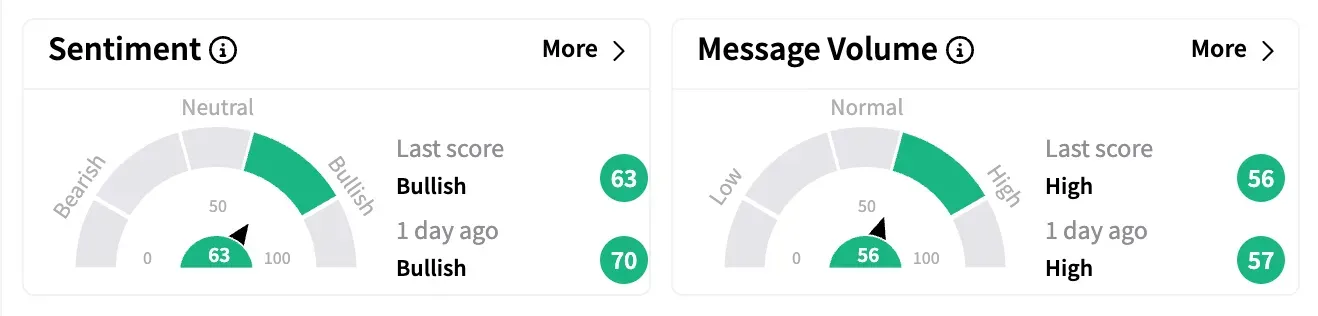

On Stocktwits, retail sentiment mirrored the broader market mood. Novo Nordisk followers stayed 'bullish,' while Eli Lilly watchers turned cautiously pessimistic, even as message volume surged over 340% for both stocks.

One user expects Lilly to go under $650.

Lilly's stock is already under pressure amid the broader market weakness caused by Trump's tariff war. CEO David Ricks has acknowledged there would be "trade-offs" in pharma companies, such as cuts to workforce and research & development.

However, Morgan Stanley analyst Terence Flynn sees limited impact on Lilly from the CMS decision as the proposed coverage appeared to apply only to a subset of the Medicare obesity population, based on the White House's prior estimate of 4 million newly eligible patients.

Flynn added that Medicare already covers GLP-1 drugs like Lilly's Zepbound and Novo's Wegovy for patients with type 2 diabetes or obesity with related comorbidities but not for those with obesity alone.

Novo, meanwhile, sparked optimism following media reports that the company plans to invest 6.4 billion reais ($1.09 billion) to expand its manufacturing capacity in Brazil and expedite the launch of its weight-loss drug, Wegovy, in India.

These moves could offset potential revenue impacts from the lack of Medicare coverage in the U.S.

An ongoing Stocktwits poll also shows that Novo has the edge over Lilly among weight loss stocks that retail traders prefer.

Lilly's stock is down over 7% this year, while Novo has lost more than 27%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)