Advertisement|Remove ads.

Retail Traders Bet Oklo Will Be Biggest Winner Under Trump’s Nuclear Energy Agenda

Retail investors have picked Oklo Inc. (OKLO) to emerge as the biggest beneficiary in the nuclear industry amid an expected surge in demand.

Last week, U.S. President Donald Trump signed several executive orders to boost nuclear power generation, including overhauling the independent Nuclear Regulatory Commission (NRC), shortening reactor approval times, opening up federal lands for uranium production and enrichment, and building new reactors.

Trump declared an energy emergency after taking the oath for the second time. U.S. power demand is growing at the fastest pace in decades, fueled by a rising number of artificial intelligence data centers,

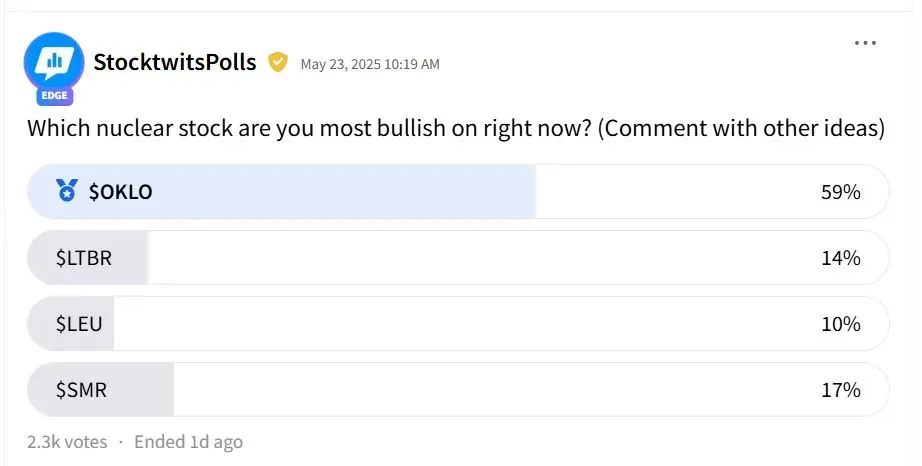

According to a Stocktwits poll, 59% of retail traders are most bullish on Oklo. Between 10% and 17% of traders have pinned their hopes on Lightbridge Corp (LTBR), Centrus Energy Corp (LEU), and NuScale Power Corp (SMR).

Oklo is designing a microreactor that requires much less space and uranium. The company plans to submit its former combined license application to the U.S. NRC by the end of this year and deploy its first commercial power plant at Idaho National Laboratory by the end of 2027.

Following the initial reports about the executive orders, Wedbush analyst Daniel Ives said the company could accelerate the timeline through higher federal funding and a much more streamlined regulatory process, as per TheFly.

“I wouldn't bet against a founder and CEO that was literally in the White House when the president signed an executive order,” one user said before adding that the stock presented a lifetime opportunity.

“OKLO is not profitable and is a small emerging company. Why is its stock price so inflated compared to other nuclear energy companies in the United States?” another user wondered.

Last month, OpenAI CEO Sam Altman stepped down from his position as chairman of Oklo, enabling the company to work with the artificial intelligence giant without conflicts of interest in the future.

Nuclear power represents about 18% of the total electricity generation capacity in the U.S, slightly down from over 20% in the 90s.

Oklo stock has more than doubled this year.

Also See: Trump Tariffs: US Importers Rediscover Decades-Old ‘First Sale Rule’ To Soften Blow

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235337353_jpg_bdb561432a.webp)