Advertisement|Remove ads.

Retail’s Optimistic Ahead Of Deckers’ Q2 Report, Analysts’ Views Divided

- Deckers is expected to report a decline in adjusted EPS for Q2, the first time in over two years.

- Analysts' views are divided, with an equal number recommending holding and buying the stock ahead of the quarterly report.

- Deckers is reporting results after-market hours on Thursday.

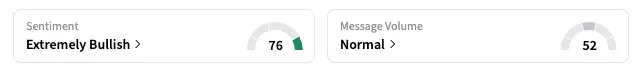

Stocktwits sentiment for Deckers Outdoor Corp.’s stock moved to ‘extremely bullish’ early Thursday, from ‘bearish’ the previous day, as investors prepared for the shoe brand’s quarterly report scheduled during post-market hours.

The company is expected to report a dip in profit for the first time since its fiscal first quarter of 2023. Analysts expect adjusted EPS to drop to $1.58 from $1.59 a year ago, according to Koyfin, a sign that Deckers is likely facing margin pressure due to higher costs associated with the U.S. trade tariffs.

Revenue for the company’s fiscal second quarter is expected to rise 8.2% to $1.42 billion, with the growth rate falling below 10% for the second time in the past two years.

However, the retail investor community is upbeat, with optimism for the stock likely driven by the recent correction as well as the company's strong first-quarter report in July. Last quarter’s earnings showed strong momentum in international markets.

“Hoka is the gold standard in athletic footwear. Period. Nothing comes close. I’ll ride the wave on the good news, and gobble up the dips on any bad,” said a Stocktwits user.

Deckers, known for its Hoka running shoes and UGG boots, faces competition from a resurging Nike and other legacy and new-age brands.

The view on Wall Street is, however, divided. Several brokerages, such as Evercore ISI, TD Cowen, and UBS, trimmed their price targets on the stock in recent weeks. Bernstein initiated coverage on DECK last month with an ‘Underperform’ rating.

Currently, 12 analysts rate the stock ‘Hold’ and the same number rate it ‘Buy’ or higher, with one ‘Sell’ and ‘Strong Sell’ ratings, according to Koyfin data. Their average price target of $127.80 implies a 27% upside to the stock’s last close.

DECK stock is down 50% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)