Advertisement|Remove ads.

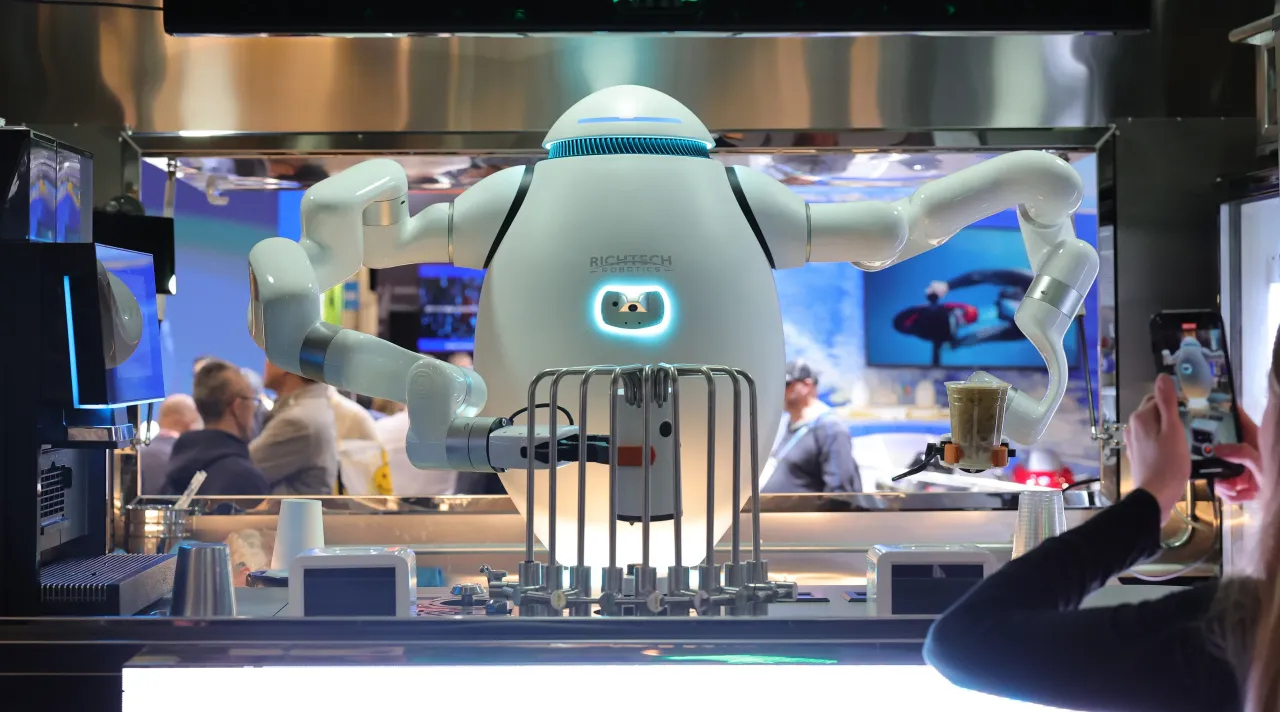

Richtech Robotics Stock Sees Retail Chatter Double In A Day: Analyst Says Company's Longer-Term Visibility Is Improving

Richtech Robotics Inc. (RR) stock witnessed retail chatter around the company more than double on Stocktwits over the past day, as retail users discussed the company’s upcoming showcase at an Nvidia Corp. (NVDA) event in October.

“People have been asking. We’ve been building. The next era of manufacturing is human + humanoid,” Richtech said in a post on X. The firm previously stated in another post on the social media platform that it is among the first companies to adopt Nvidia’s Jetson Thor to power its robots.

Richtech Robotics’ shares were up nearly 19% in Monday’s midday trade. Retail sentiment around the company on Stocktwits trended in the ‘extremely bullish’ territory. Richtech was the fifth most trending stock on the platform at the time of writing. The company develops AI-driven robotics solutions for clients across various industries, including service and hospitality, retail, logistics, and more.

On Friday, H.C. Wainwright analyst Scott Buck raised the price target for the RR stock to $6 from $3.5, while maintaining a ‘Buy’ rating, according to TheFly. Buck stated that Richtech continues to have meaningful discussions with potential customers amid an increase in interest in service robots. The analyst added that new investors should gravitate towards robotics.

Buck also added that the longer-term visibility around Richtech is improving as interest rates decline. This comes at a time when the Federal Reserve cut the key borrowing rate by 25 basis points last week.

In August, Richtech launched a $100 million stock sale plan via a new at-the-market (ATM) equity offering.

RR stock is up 96% year-to-date and 625% over the past 12 months.

Get updates to this story developing directly on Stocktwits.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)