Advertisement|Remove ads.

Riot Ramps Up Crypto Mining Efficiency, Slashes Power Costs In June: Retail Stays Bullish

Bitcoin mining and digital infrastructure company Riot Platforms, Inc. (RIOT) released its June 2025 production and operational figures on Thursday, clocking a 76% year-over-year growth in Bitcoin output despite slight monthly declines.

The company generated 450 BTC in June, a 12% decrease from May but a 76% increase from June 2024, while its daily output averaged 15 BTC. Riot held 19,273 BTC at the end of the month, a 106% rise from a year ago.

Following the news, Riot Platforms’ stock inched 0.7% higher in Thursday morning trade. Bitcoin’s price had also increased by 1.4% in the last 24 hours, trading at around $109,872.

Riot sold 397 BTC in June, reducing monthly sales by 21%, and earned $41.7 million, 19% less than the $ 51.8 million in May. However, the average net price climbed 2% to $105,071 per Bitcoin.

Total deployed hash rate remained flat at 35.5 exahashes per second (EH/s), a 62% increase YoY. Operating hash rate slipped 5% from May to 29.8 EH/s but surged 162% compared to June 2024.

Fleet efficiency improved to 21.2 J/TH, an 18% year-on-year (YoY) surge. June’s power credit revenue jumped 141% to $5.6 million from May, with demand response credits increasing slightly month-over-month to $1.8 million.

The company also reduced its all-in power cost by 11% to 3.4¢/kWh.

In early June, Riot offloaded approximately 1.75 million Canadian crypto miner Bitfarms (BITF) common shares, which account for about 0.31% of Bitfarms’ outstanding shares.

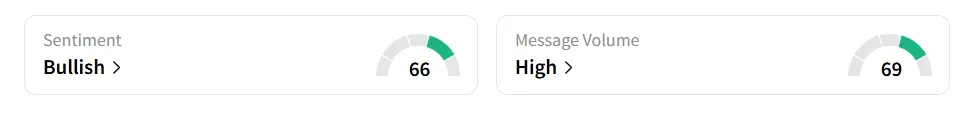

On Stocktwits, retail sentiment towards Riot Platforms remained in ‘bullish’ territory with ‘high’ message volume levels.

Riot Platforms’ stock has gained over 21% year-to-date and over 29% in the last 12 months.

Also See: AST SpaceMobile Lands $100M Financing Deal, But Retail Stays Skeptical

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)