Advertisement|Remove ads.

Rocket Companies Stock Slips After Tepid Q2 View, Top Mortgage Lender Says Homebuying Season Delayed: Retail’s Still Bullish

Rocket Companies (RKT) stock slipped in extended trading on Thursday after the company forecast second-quarter revenue below Wall Street’s estimates and flagged a slowdown in homebuying due to tariff uncertainty.

The mortgage lender forecasted second-quarter revenue between $1.175 billion and $1.325 billion, which fell short of analysts’ expectations of $1.36 billion, according to FinChat data.

“We think the home buying season got delayed a bit with the volatility in April, but has potential to finish strong,” CEO Varun Krishna said.

While mortgage rates scaled down during the first quarter, U.S. President Donald Trump’s tariff announcements pushed them up again amid a decline in consumer sentiment.

The company said weekly purchase applications declined by double-digit percentage points throughout April, which the industry hadn’t witnessed since the financial crisis of 2008.

It reported a net loss of $212 million, or $0.08 per share, for the first quarter, compared with a profit of $291 million, or $0.11 per share.

According to FinChat data, the company’s adjusted revenue of $1.30 billion topped estimates of $1.25 billion.

The company said Rocket Mortgage generated $26.1 billion in net rate lock volume, a 17% increase from last year. A rate lock denotes a fixed mortgage rate agreed upon between the lender and borrower.

The company's sold loan volume in the direct-to-consumer segment rose to $11.30 billion during the quarter, up from $9.05 billion last year.

The Detroit-based company has been looking to cement its position as an industry leader by acquiring rivals Redfin and Mr. Cooper.

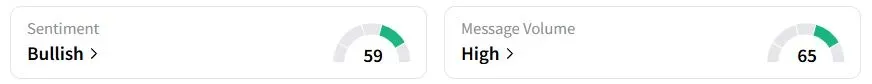

Retail sentiment on Stocktwits was in the ‘bullish’ (59/100) territory, while retail chatter was ‘high.’

One user was optimistic about the stock on the company’s forecast for a potential market stabilization in May and June.

Another user said that the company’s recent acquisitions and potential interest rate cuts in the future could push the stock higher.

Rocket Companies' stock has risen 8.7% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)