Advertisement|Remove ads.

Lyft Stock Rallies After $750M Buyback Boost, Eyes Expansion In Europe And Smaller Cities: Retail’s Bullish

Lyft (LYFT) stock rose 7.3% in extended trading on Thursday after the company boosted its share buyback program to $750 million.

The ride-hailing firm said it would utilize $500 million of this authorization within the next 12 months, with $200 million to be used in the next three months.

Last month, activist investor Engine Capital pushed Lyft to launch an accelerated share buyback and explore strategic alternatives, including a sale.

Lyft reported a net income of $2.6 million, or $0.01 per share, for the quarter ended March 31, compared with a loss of $31.5 million, or $0.08 per share, a year earlier.

Its quarterly revenue of $1.45 billion fell short of Wall Street’s estimates of $1.47 billion.

Lyft reported a 13% rise in gross bookings for the first quarter to $4.16 billion, while total rides jumped to 218.4 million from 187.7 million.

“Rides and driver hours in the last week of March surpassed pre-COVID levels and reached the highest weekly levels in the history of Lyft,” the company said.

Lyft forecasted second-quarter gross bookings between $4.41 billion and $4.57 billion, compared with the analysts’ expectations of $4.48 billion, according to FactSet data.

The company and its larger rival, Uber, are rapidly expanding into smaller cities with limited public transportation.

“Cities like Indianapolis, where we achieved 37% year-over-year ride growth, demonstrate the potential of Lyft as a key transportation solution in these areas,” the company said in a statement.

Last month, the company agreed to buy Freenow to expand into Europe and double its addressable market.

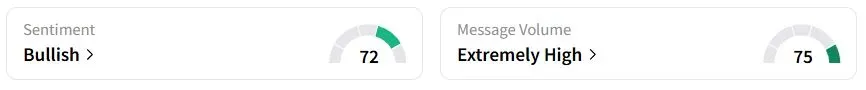

Retail sentiment on Stocktwits was in the ‘bullish’ (72/100) territory, while retail chatter was ‘extremely high.’

One Stocktwits user, who claimed to be a Lyft driver, said that long wait times, inconsistent pricing, and a general disdain for the "big guy" have driven more riders to choose Lyft over Uber in North Carolina.

Another user said that Lyft could partner with healthcare providers with Lyft Silver, which is aimed at older adults.

Lyft stock is down marginally this year.

Also See: Kraft Heinz Reportedly Seeks 2-Month Notice From Coffee Suppliers Before Tariff-Driven Price Hikes

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)