Advertisement|Remove ads.

Roku Soars 9% After Guggenheim Upgrade: Here’s What Retail Is Thinking

Shares of video-streaming platform Roku rose over 9% on Friday after Guggenheim reportedly upgraded the stock to ‘Buy’ from ‘Neutral’ while keeping a price target of $75.

The brokerage expects investor enthusiasm to continue into the third quarter as the firm makes progress toward expanding video inventory advertising sales through third-party demand-side platforms and improved home screen monetization.

Guggenheim also said its revised rating reflects the firm’s financial estimates being ahead of consensus for 2024 and 2025 and its attractive relative valuation.

The brokerage, however, noted that its primary concerns remain unchanged. One of the firm’s worries is that leadership has been slow to take advantage of its dominant position in the connected TV marketplace. Guggenheim also noted that competition in the advertising and CTV marketplaces could pressure financial performance.

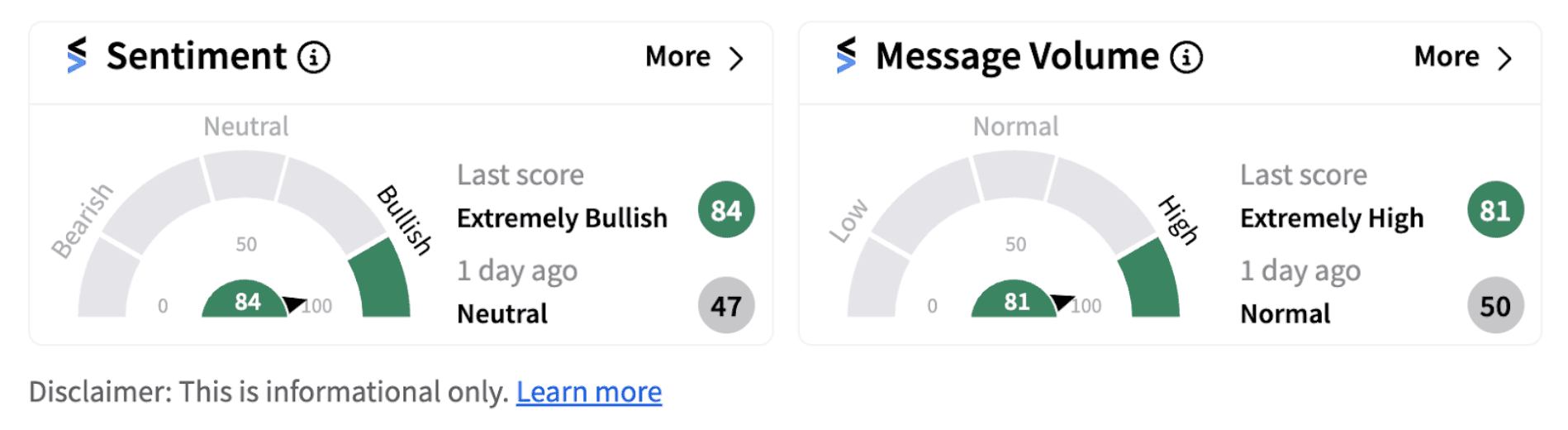

Following the upgrade, retail sentiment on Roku shifted into ‘bullish’ territory (84/100) from ‘neutral’ zone a day ago, accompanied by high message volume (81/100).

During the second quarter of fiscal year 2024, Roku reported a 14% year-over-year (YoY) rise in its net revenue at $965.20 million. However, the company’s average revenue per user (ARPU) remained flat at $40.68 YoY.

The company said continued growth in scale and engagement, along with the execution of its monetization initiatives has positioned it strongly in the ongoing shift to streaming. For the second half of 2024, the firm expects these initiatives to help accelerate revenue from advertising activities.

For the third quarter, the company estimates 11% YoY growth in its total net revenue at $1.01 billion with Platform revenue growing 9% YoY and Devices revenue growing 24% YoY.

Stocktwits users are enthusiastic about the upgrade. A bullish user believes the stock may cross the $99 mark by the end of the year.

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_da95861470.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233716109_jpg_230d917a7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)