Advertisement|Remove ads.

ROOT Stock Surges 29% After Company’s Q4 Earnings Shatter Wall Street Estimates: Retail’s Elated

Shares of Root Inc. (ROOT) surged 29% on Thursday after the company's strong fourth-quarter performance.

Revenue rose 68% year-over-year (YoY) to $326.7 million during the quarter, far exceeding a Wall Street estimate of $287.79 million. Earnings per share (EPS) came in at $1.3 compared to an estimated loss of $0.48.

The company reported a net income attributable to common stockholders of $20.9 million compared to a net loss of $24 million in the same quarter a year ago.

Gross premiums earned increased 54% to $331 million during the quarter.

CEO Alex Timm highlighted the 21% growth in policies in force, particularly despite the relative youth of the company’s book following a hyper-growth period early in the year.

“As Root grows, our marketing spend may impact the degree of profitability in any given calendar quarter as we do not defer the majority of customer acquisition cost over the life of our customers. Acquisition expenses in our Direct channel will vary and will be deployed at attractive expected returns over the customer lifecycle,” he said.

Root stated that due to its debt refinance in October 2024, the company expects to lower interest expense on a run rate basis by approximately 50% going into 2025.

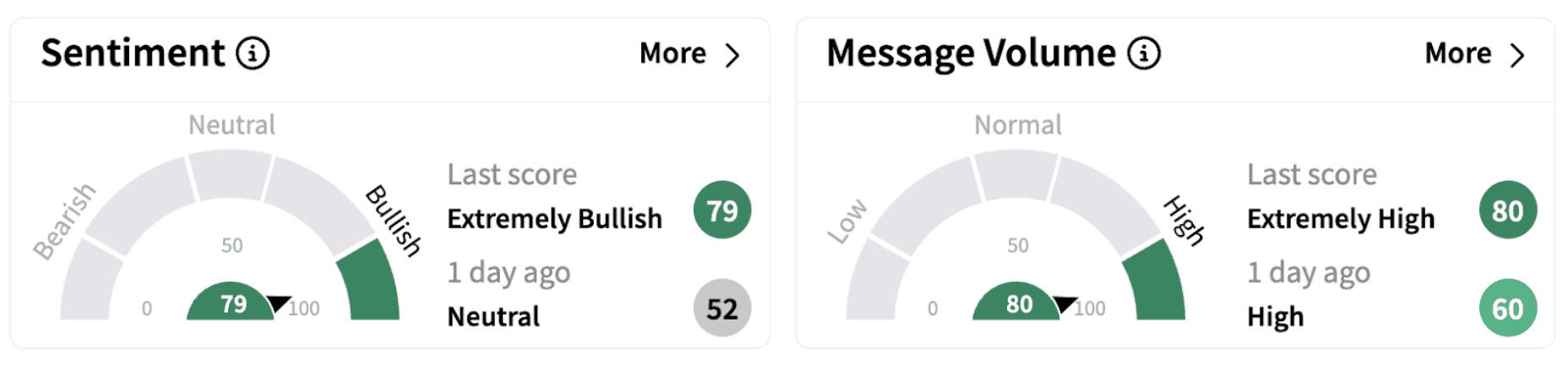

On Stocktwits, retail sentiment flipped into the ‘extremely bullish’ territory (79/100) from ‘neutral’ a day ago. The move was accompanied by significant retail chatter.

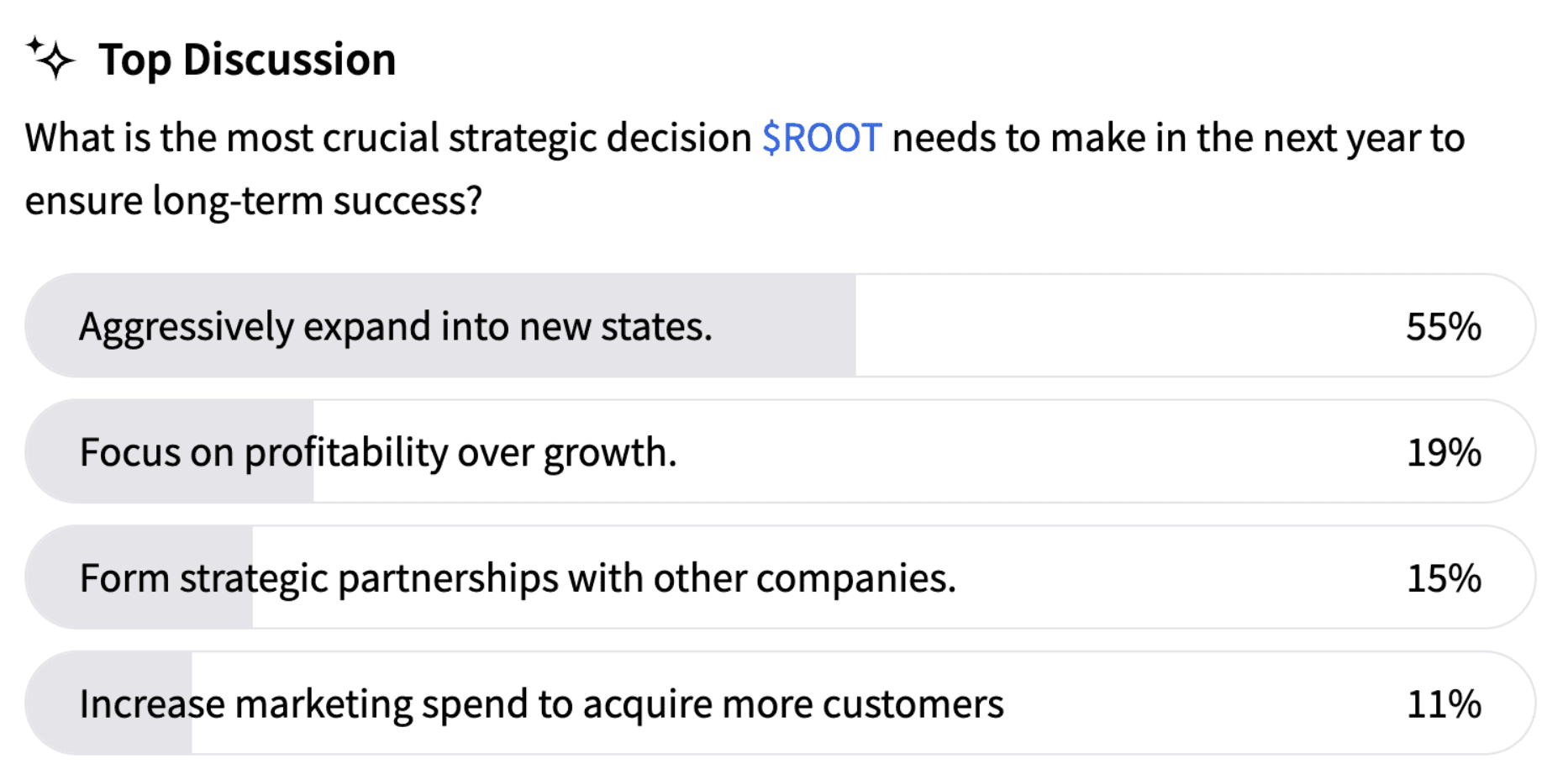

A Stocktwits poll asked users about the most crucial strategic decision that ROOT needs to make next year to ensure long-term success. Fifty-five percent of respondents said the company must aggressively expand into new states.

Nineteen percent of the respondents feel Root should focus on profitability over growth, while 15% said it should form strategic partnerships with other companies.

Only 11% believe the company should increase its marketing spending to acquire more customers.

Meanwhile, Stocktwits users are expressing optimism on ROOT shares.

According to TheFly, Wells Fargo raised its price target on Root to $97 from $80 while keeping an ‘Equal Weight’ rating on the shares.

ROOT shares have gained over 73% in 2025 and over 405% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)