Advertisement|Remove ads.

RR Kabel Charts Golden Cross After Months Of Weakness: SEBI RA Sees Potential Upside Of Over 20%

After facing sustained selling pressure since October of last year, wire manufacturer RR Kabel is beginning to show signs of reversal. The stock rose in four of the previous five sessions.

At the time of writing, RR Kabel shares were up 5% at ₹1,460.90.

The stock has moved above its 200-day exponential moving average (EMA), a strong indicator of a shift in long-term sentiment, said SEBI-registered analyst Mayank Singh Chandel.

Charts indicate the formation of a Golden Cross, a strong bullish signal that occurs when the 50-day EMA crosses above the 200-day EMA.

The latest rally was also accompanied by upward price gaps, pointing to accumulation and renewed investor interest. However, the stock is currently consolidating in a sideways range, a typical move after an uptrend.

A decisive breakout above ₹1,452, supported by high volumes, could act as a fresh trigger for the next leg higher. If this breakout holds, the stock could potentially move toward ₹1,785 in the medium term. Chandel also recommends placing a stoploss at ₹1,240, just below the 50-day EMA.

Recently, the company announced a final dividend of ₹3.50 per share, with the ex-date on July 14.

The recent rally has led to a 9.2% gain over the past week. Year-to-date (YTD) gains stand at a modest 1.8%, while over a one-year period, RR Kabel shares have shed nearly 18%.

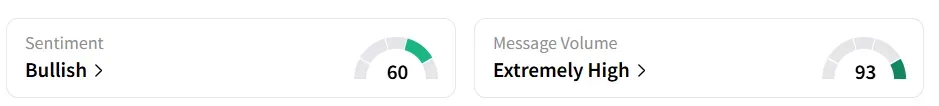

Retail sentiment on Stocktwits changed from ‘extremely bullish’ to ‘bullish’, amid ‘extremely high’ message volumes.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)