Advertisement|Remove ads.

Ryanair Fares Jump As 'Whole Of Europe Seems To Be Traveling' — CEO Shrugs Off Trump Tariffs For Now

Ryanair’s (RYAAY) U.S. shares garnered retail attention on Monday after the company said its fares rose amid strong travel demand in Europe.

The Dublin-based company said its fiscal first-quarter fares are on track to finish a mid-high teen percentage point higher than a year earlier.

“The whole of Europe seems to be traveling,” CEO Michael O’Leary said to Bloomberg Television before adding, “There is a reluctance to go transatlantic at the moment.”

O'Leary said separately in a post-earnings video presentation that summer bookings are running about 1% ahead of the same period a year earlier.

The low-cost carrier said its full-year profit after tax fell 16% to 1.61 billion euros amid high interest rates. However, the airline saw a 9% rise in passenger traffic to just over 200 million.

The company also launched a 750 million euros ($839 million) share buyback program and expects to complete it within the next 12 months.

Ryanair expects delivery delays of Boeing aircraft to constrain its passenger traffic growth in fiscal 2026 to 3%.

"We don't think it will be of much impact, but it's too soon to call," O'Leary said on the impact of tariffs on deliveries.

However, the company expects Boeing to bear any tariff-related expenses as it has agreed to a fixed-price contract with the planemaker.

The company, which operates an all-Boeing fleet, might consider Airbus or COMAC aircraft if they are significantly cheaper than Boeing. It is scheduled to take deliveries of hundreds of aircraft over the next decade from the U.S. firm.

O’Leary also said to Bloomberg, “Huge volumes of Americans are coming to Europe for the summer.”

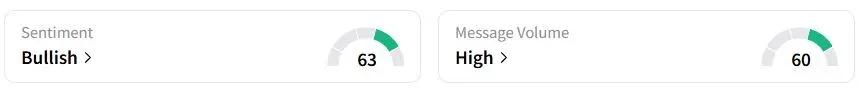

Retail sentiment on Stocktwits was in the ‘bullish’ (63/100) territory, while retail chatter was ‘high.’

Ryanair stock has gained 14.7% year to date (YTD).

Also See: China’s Factory Output Shows Resilience Amid Tariff War — Retail Sales Remain A Worrying Sign

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)